Summary

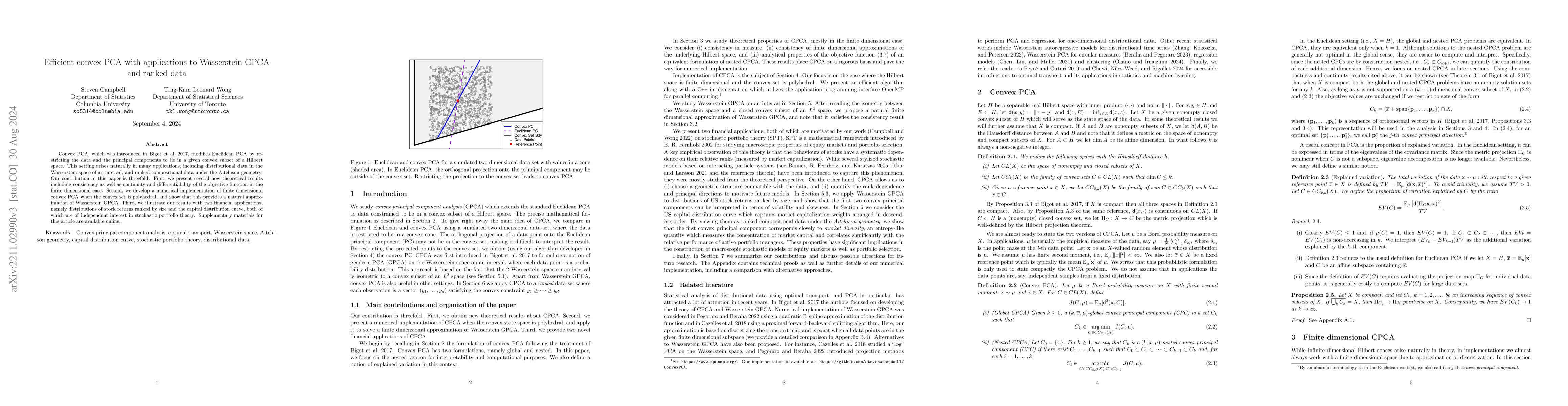

Convex PCA, which was introduced by Bigot et al., is a dimension reduction methodology for data with values in a convex subset of a Hilbert space. This setting arises naturally in many applications, including distributional data in the Wasserstein space of an interval, and ranked compositional data under the Aitchison geometry. Our contribution in this paper is threefold. First, we present several new theoretical results including consistency as well as continuity and differentiability of the objective function in the finite dimensional case. Second, we develop a numerical implementation of finite dimensional convex PCA when the convex set is polyhedral, and show that this provides a natural approximation of Wasserstein geodesic PCA. Third, we illustrate our results with two financial applications, namely distributions of stock returns ranked by size and the capital distribution curve, both of which are of independent interest in stochastic portfolio theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)