Summary

We study the estimation of a high dimensional approximate factor model in the presence of both cross sectional dependence and heteroskedasticity. The classical method of principal components analysis (PCA) does not efficiently estimate the factor loadings or common factors because it essentially treats the idiosyncratic error to be homoskedastic and cross sectionally uncorrelated. For efficient estimation it is essential to estimate a large error covariance matrix. We assume the model to be conditionally sparse, and propose two approaches to estimating the common factors and factor loadings; both are based on maximizing a Gaussian quasi-likelihood and involve regularizing a large covariance sparse matrix. In the first approach the factor loadings and the error covariance are estimated separately while in the second approach they are estimated jointly. Extensive asymptotic analysis has been carried out. In particular, we develop the inferential theory for the two-step estimation. Because the proposed approaches take into account the large error covariance matrix, they produce more efficient estimators than the classical PCA methods or methods based on a strict factor model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

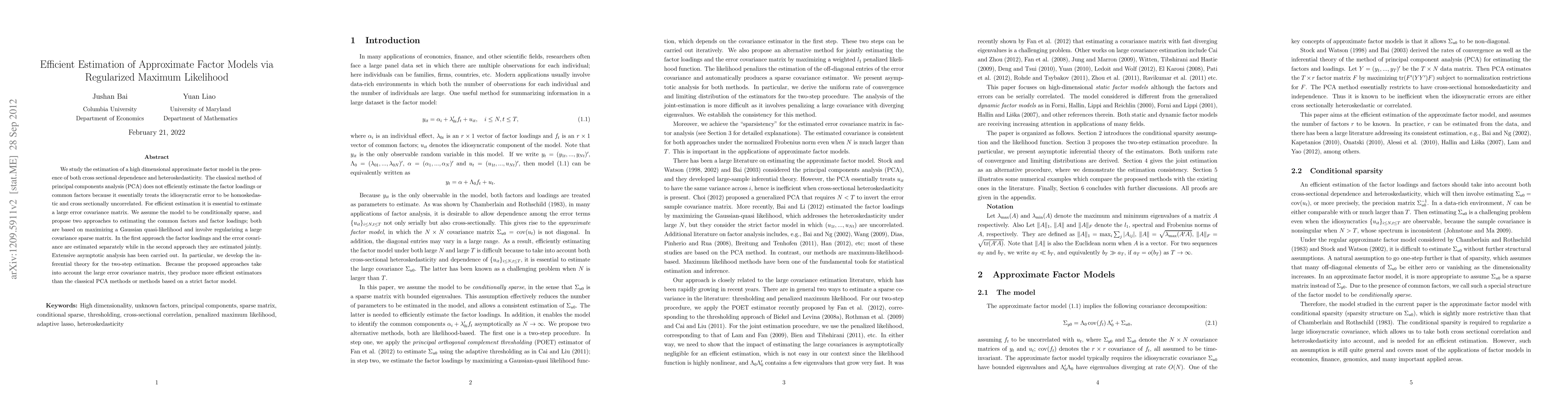

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuasi maximum likelihood estimation of high-dimensional approximate dynamic matrix factor models via the EM algorithm

Matteo Barigozzi, Luca Trapin

| Title | Authors | Year | Actions |

|---|

Comments (0)