Summary

We prove simple general formulas for expectations of functions of a L\'evy process and its running extremum. Under additional conditions, we derive analytical formulas using the Fourier/Laplace inversion and Wiener-Hopf factorization, and discuss efficient numerical methods for realization of these formulas. As applications, the cumulative probability distribution function of the process and its running maximum and the price of the option to exchange the power of a stock for its maximum are calculated. The most efficient numerical methods use the sinh-acceleration technique and simplified trapezoid rule. The program in Matlab running on a Mac with moderate characteristics achieves the precision E-7 and better in several milliseconds, and E-14 - in a fraction of a second.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

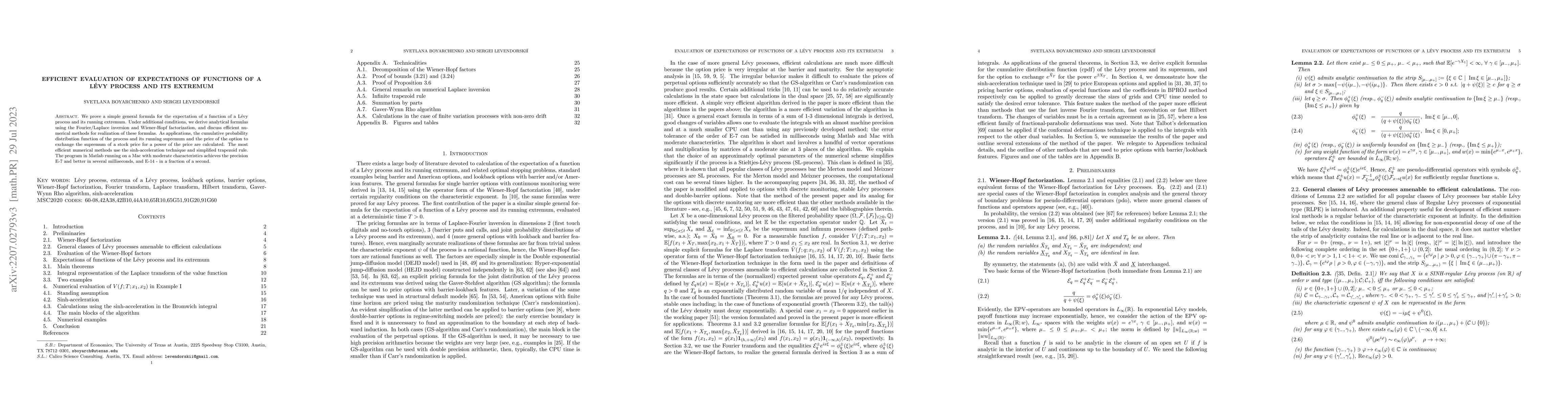

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient evaluation of expectations of functions of a stable L\'evy process and its extremum

Svetlana Boyarchenko, Sergei Levendorskiĭ

Simulation of a L\'evy process, its extremum, and hitting time of the extremum via characteristic functions

Svetlana Boyarchenko, Sergei Levendorskii

Efficient evaluation of joint pdf of a L\'evy process, its extremum, and hitting time of the extremum

Svetlana Boyarchenko, Sergei Levendorskii

Efficient evaluation of double-barrier options and joint cpdf of a L\'evy process and its two extrema

Svetlana Boyarchenko, Sergei Levendorskiĭ

| Title | Authors | Year | Actions |

|---|

Comments (0)