Authors

Summary

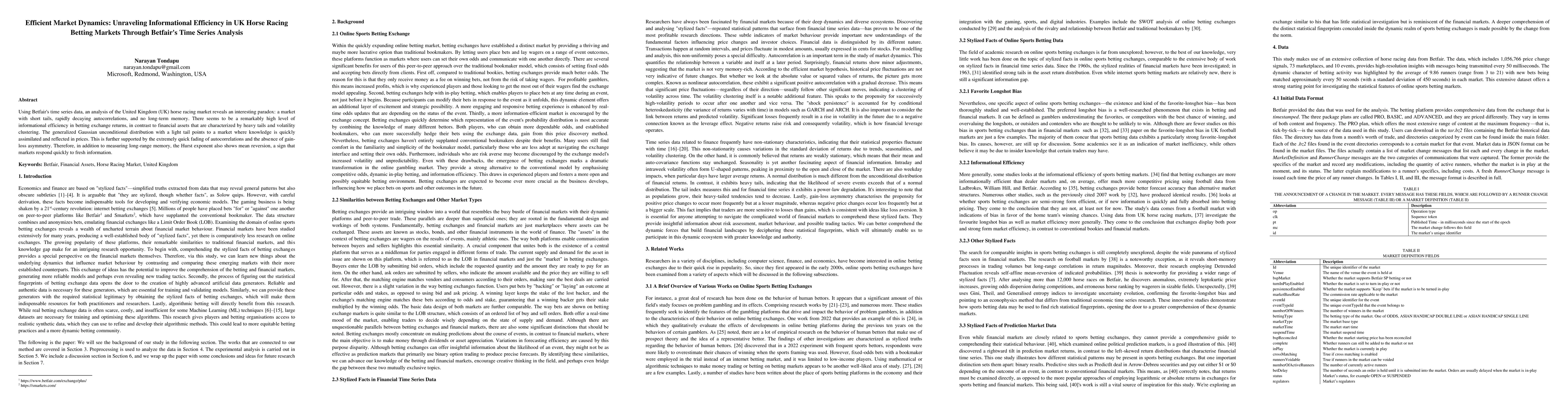

Using Betfair's time series data, an analysis of the United Kingdom (UK) horse racing market reveals an interesting paradox: a market with short tails, rapidly decaying autocorrelations, and no long-term memory. There seems to be a remarkably high level of informational efficiency in betting exchange returns, in contrast to financial assets that are characterized by heavy tails and volatility clustering. The generalized Gaussian unconditional distribution with a light tail point to a market where knowledge is quickly assimilated and reflected in prices. This is further supported by the extremely quick fading of autocorrelations and the absence of gain-loss asymmetry. Therefore, in addition to measuring long-range memory, the Hurst exponent also shows mean reversion, a sign that markets respond quickly to fresh information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOrnstein-Uhlenbeck Process for Horse Race Betting: A Micro-Macro Analysis of Herding and Informed Bettors

Shintaro Mori, Tomoya Sugawara

No citations found for this paper.

Comments (0)