Summary

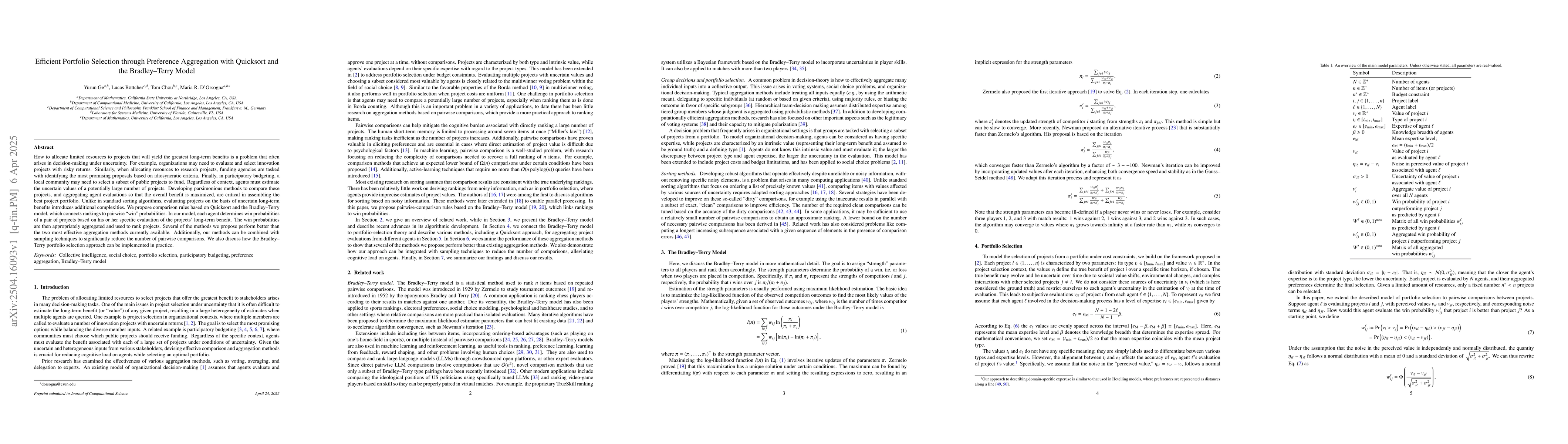

How to allocate limited resources to projects that will yield the greatest long-term benefits is a problem that often arises in decision-making under uncertainty. For example, organizations may need to evaluate and select innovation projects with risky returns. Similarly, when allocating resources to research projects, funding agencies are tasked with identifying the most promising proposals based on idiosyncratic criteria. Finally, in participatory budgeting, a local community may need to select a subset of public projects to fund. Regardless of context, agents must estimate the uncertain values of a potentially large number of projects. Developing parsimonious methods to compare these projects, and aggregating agent evaluations so that the overall benefit is maximized, are critical in assembling the best project portfolio. Unlike in standard sorting algorithms, evaluating projects on the basis of uncertain long-term benefits introduces additional complexities. We propose comparison rules based on Quicksort and the Bradley--Terry model, which connects rankings to pairwise "win" probabilities. In our model, each agent determines win probabilities of a pair of projects based on his or her specific evaluation of the projects' long-term benefit. The win probabilities are then appropriately aggregated and used to rank projects. Several of the methods we propose perform better than the two most effective aggregation methods currently available. Additionally, our methods can be combined with sampling techniques to significantly reduce the number of pairwise comparisons. We also discuss how the Bradley--Terry portfolio selection approach can be implemented in practice.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes comparison rules based on Quicksort and the Bradley--Terry model to rank projects with uncertain long-term benefits, aggregating agent evaluations to maximize overall benefit.

Key Results

- Comparison methods based on Quicksort and the Bradley--Terry model outperform existing aggregation methods.

- Proposed methods can be combined with sampling techniques to reduce pairwise comparisons significantly.

Significance

This research is important for decision-making under uncertainty in contexts like innovation project selection, research funding allocation, and participatory budgeting, providing efficient portfolio selection strategies.

Technical Contribution

The main technical contribution is the development of novel preference aggregation rules for ranking projects based on uncertain long-term benefits, integrating Quicksort and the Bradley--Terry model.

Novelty

This work introduces an innovative approach to portfolio selection by connecting rankings to pairwise 'win' probabilities, differentiating itself from existing methods that do not account for uncertain long-term benefits.

Limitations

- The paper does not discuss potential limitations of the proposed methods in detail.

- Real-world applicability and robustness under varying conditions may require further investigation.

Future Work

- Explore the applicability of the proposed methods in diverse domains and with varying numbers of agents and projects.

- Investigate the performance and robustness of the methods under different uncertainty distributions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Inference for Covariate-adjusted Bradley-Terry Model with Covariate Shift

Sijia Li, Xiudi Li

Energy-Based Preference Model Offers Better Offline Alignment than the Bradley-Terry Preference Model

Yang Song, Junwei Bao, Hongfei Jiang et al.

No citations found for this paper.

Comments (0)