Authors

Summary

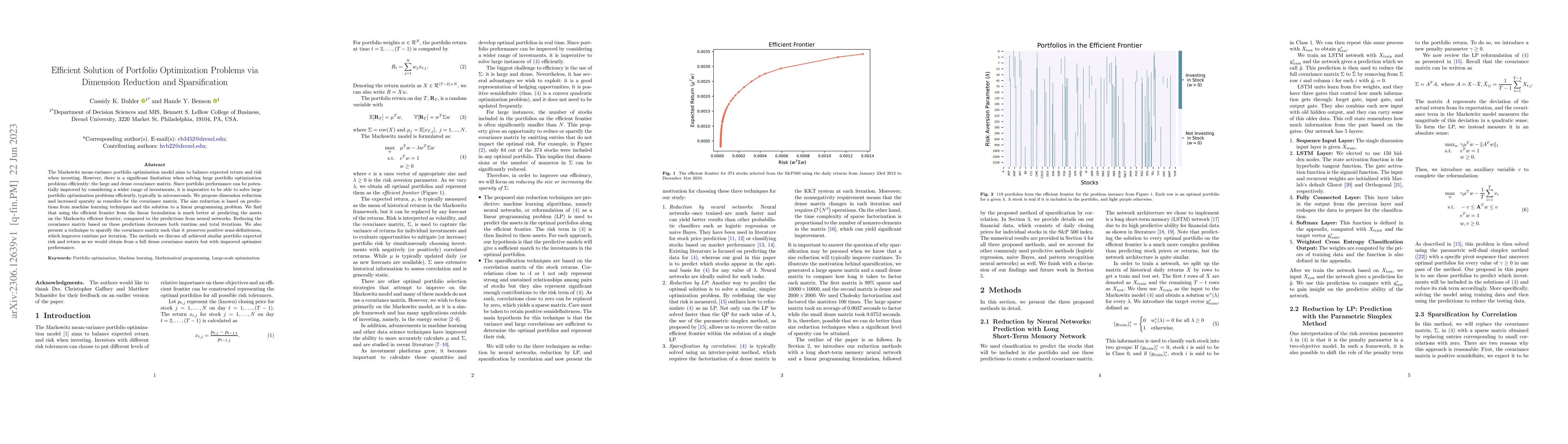

The Markowitz mean-variance portfolio optimization model aims to balance expected return and risk when investing. However, there is a significant limitation when solving large portfolio optimization problems efficiently: the large and dense covariance matrix. Since portfolio performance can be potentially improved by considering a wider range of investments, it is imperative to be able to solve large portfolio optimization problems efficiently, typically in microseconds. We propose dimension reduction and increased sparsity as remedies for the covariance matrix. The size reduction is based on predictions from machine learning techniques and the solution to a linear programming problem. We find that using the efficient frontier from the linear formulation is much better at predicting the assets on the Markowitz efficient frontier, compared to the predictions from neural networks. Reducing the covariance matrix based on these predictions decreases both runtime and total iterations. We also present a technique to sparsify the covariance matrix such that it preserves positive semi-definiteness, which improves runtime per iteration. The methods we discuss all achieved similar portfolio expected risk and return as we would obtain from a full dense covariance matrix but with improved optimizer performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDimension Reduction of Distributionally Robust Optimization Problems

Silvana M. Pesenti, Brandon Tam

No citations found for this paper.

Comments (0)