Authors

Summary

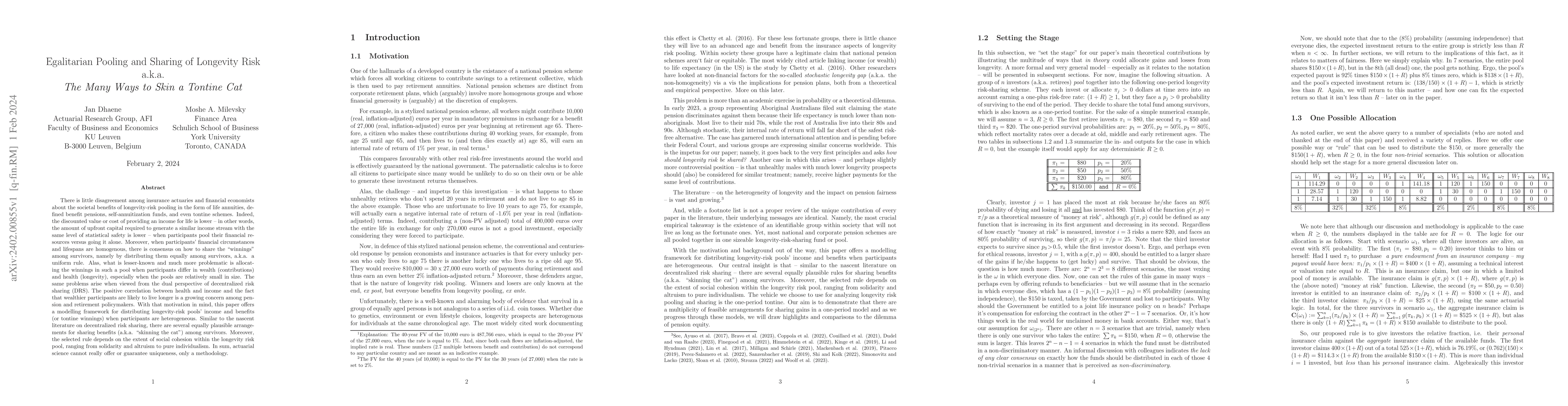

There is little disagreement among insurance actuaries and financial economists about the societal benefits of longevity-risk pooling in the form of life annuities, defined benefit pensions, self-annuitization funds, and even tontine schemes. Indeed, the discounted value or cost of providing an income for life is lower -- in other words, the amount of upfront capital required to generate a similar income stream with the same level of statistical safety is lower -- when participants pool their financial resources versus going it alone. Moreover, when participants' financial circumstances and lifespans are homogenous, there is consensus on how to share the "winnings" among survivors, namely by distributing them equally among survivors, a.k.a. a uniform rule. Alas, what is lesser-known and much more problematic is allocating the winnings in such a pool when participants differ in wealth (contributions) and health (longevity), especially when the pools are relatively small in size. The same problems arise when viewed from the dual perspective of decentralized risk sharing (DRS). The positive correlation between health and income and the fact that wealthier participants are likely to live longer is a growing concern among pension and retirement policymakers. With that motivation in mind, this paper offers a modelling framework for distributing longevity-risk pools' income and benefits (or tontine winnings) when participants are heterogeneous. Similar to the nascent literature on decentralized risk sharing, there are several equally plausible arrangements for sharing benefits (a.k.a. "skinning the cat") among survivors. Moreover, the selected rule depends on the extent of social cohesion within the longevity risk pool, ranging from solidarity and altruism to pure individualism. In sum, actuarial science cannot really offer or guarantee uniqueness, only a methodology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)