Summary

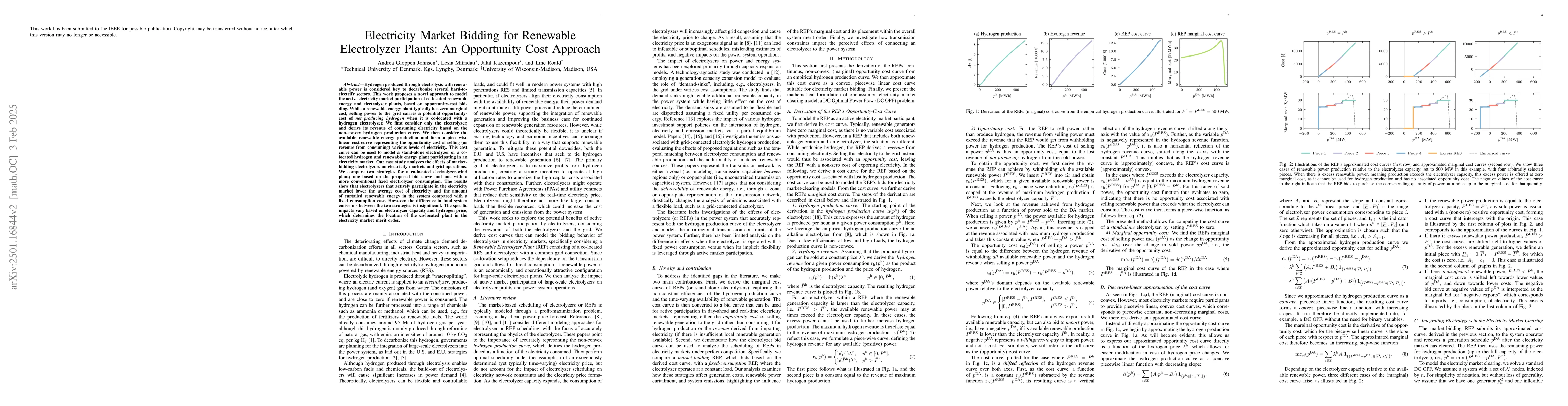

Hydrogen produced through electrolysis with renewable power is considered key to decarbonize several hard-to-electrify sectors. This work proposes a novel approach to model the active electricity market participation of co-located renewable energy and electrolyzer plants, based on opportunity-cost bidding. While a renewable energy plant typically has zero marginal cost, selling power to the grid carries a potential opportunity-cost of not producing hydrogen when it is co-located with a hydrogen electrolyzer. We first consider only the electrolyzer, and derive its revenue of consuming electricity based on the non-convex hydrogen production curve. We then consider the available renewable energy production and form a piece-wise linear cost curve representing the opportunity cost of selling (or revenue from consuming) various levels of electricity. This cost curve can be used to model a stand-alone electrolyzer or a co-located hydrogen and renewable energy plant participating in an electricity market. Our case study analyzes the effects of market-bidding electrolyzers on electricity markets and grid operations. We compare two strategies for a co-located electrolyzer-wind plant; one based on the proposed bid curve and one with a more conventional fixed electrolyzer consumption. The results show that electrolyzers that actively participate in the electricity market lower the average cost of electricity and the amount of curtailed renewable energy in the system compared with a fixed consumption case. However, the difference in total system emissions between the two strategies is insignificant. The specific impacts vary based on electrolyzer capacity and hydrogen price, which determines the location of the co-located plant in the electricity market merit order.

AI Key Findings

Generated Jun 13, 2025

Methodology

This research proposes a novel approach to model the active electricity market participation of co-located renewable energy and electrolyzer plants, based on opportunity-cost bidding. It derives an electrolyzer's revenue curve from non-convex hydrogen production and forms a piece-wise linear cost curve representing the opportunity cost of selling or consuming electricity.

Key Results

- Electrolyzers that actively participate in the electricity market lower the average cost of electricity and the amount of curtailed renewable energy compared to a fixed consumption case.

- The difference in total system emissions between market-bidding electrolyzers and fixed consumption electrolyzers is insignificant.

- Specific impacts vary based on electrolyzer capacity and hydrogen price, which determine the location of the co-located plant in the electricity market merit order.

Significance

This work is significant as it facilitates the integration of renewable energy and electrolyzer plants in electricity market-clearing models, providing insights into their system-wide impacts on emissions, costs, and congestion.

Technical Contribution

The paper presents a method to derive an opportunity-cost curve for renewable energy and electrolyzer plants, enabling their efficient integration into electricity market models.

Novelty

This research introduces a novel approach to model co-located renewable energy and electrolyzer plants' participation in electricity markets, considering the opportunity cost of not producing hydrogen when selling power to the grid.

Limitations

- The study assumes perfect competition in electricity markets and does not consider market power or strategic behavior of market participants.

- The analysis is based on a single test system (RTS-GMLC) and might not generalize to all power systems without further validation.

Future Work

- Investigate the impact of market power and strategic behavior on the proposed methodology.

- Validate the findings on a broader range of power systems to ensure generalizability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBidding strategies for energy storage players in 100% renewable electricity market: A game-theoretical approach

Xiufeng Liu, Arega Getaneh Abate, Dogan Keles et al.

Optimizing Bidding Curves for Renewable Energy in Two-Settlement Electricity Markets

Audun Botterud, Dongwei Zhao, Stefanos Delikaraogloub et al.

Deep Learning-Based Electricity Price Forecast for Virtual Bidding in Wholesale Electricity Market

Xuesong Wang, Caisheng Wang, Sharaf K. Magableh et al.

Flexible Robust Optimal Bidding of Renewable Virtual Power Plants in Sequential Markets

Enrique Lobato, Lukas Sigrist, Luis Rouco et al.

No citations found for this paper.

Comments (0)