Summary

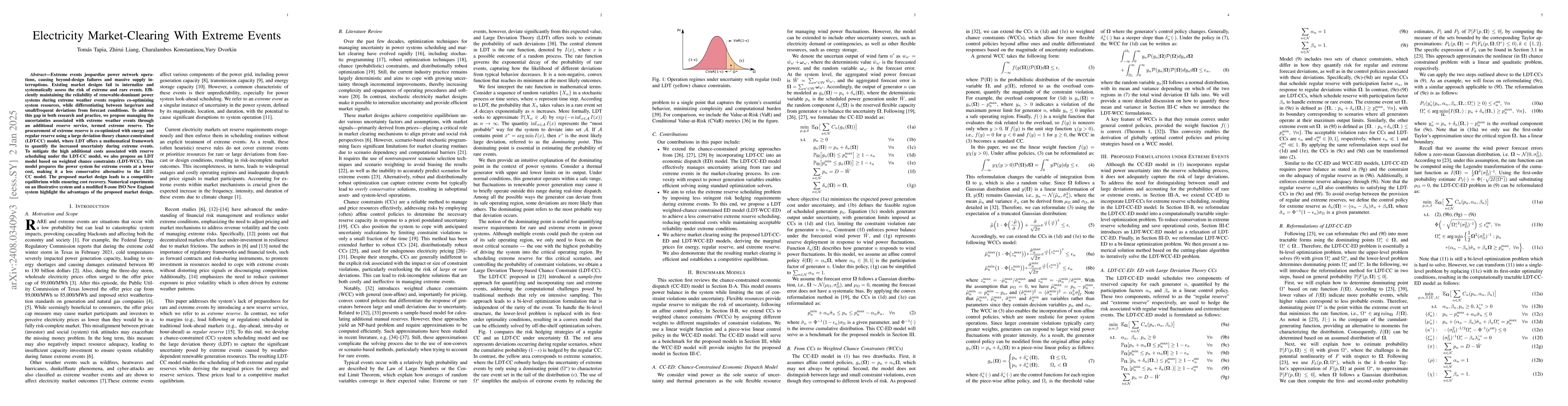

Extreme events jeopardize power network operations, causing beyond-design failures and massive supply interruptions. Existing market designs fail to internalize and systematically assess the risk of extreme and rare events. Efficiently maintaining the reliability of renewable-dominant power systems during extreme weather events requires co-optimizing system resources, while differentiating between large/rare and small/frequent deviations from forecast conditions. To address this gap in both research and practice, we propose managing the uncertainties associated with extreme weather events through an additional reserve service, termed extreme reserve. The procurement of extreme reserve is co-optimized with energy and regular reserve using a large deviation theory chance-constrained (LDT-CC) model, where LDT offers a mathematical framework to quantify the increased uncertainty during extreme events. To mitigate the high additional costs associated with reserve scheduling under the LDT-CC model, we also propose an LDT model based on weighted chance constraints (LDT-WCC). This model prepares the power system for extreme events at a lower cost, making it a less conservative alternative to the LDT-CC model. The proposed market design leads to a competitive equilibrium while ensuring cost recovery. Numerical experiments on an illustrative system and a modified 8-zone ISO New England system highlight the advantages of the proposed market design.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGreening the Grid: Electricity Market Clearing with Consumer-Based Carbon Cost

Line Roald, Wenqian Jiang

Machine Learning for Electricity Market Clearing

Michael Chertkov, Laurent Pagnier, Robert Ferrando et al.

Strategic Bidding in Electricity Markets with Convexified AC Market-Clearing Process

Saeed D. Manshadi, Arash Farokhi Soofi

No citations found for this paper.

Comments (0)