Summary

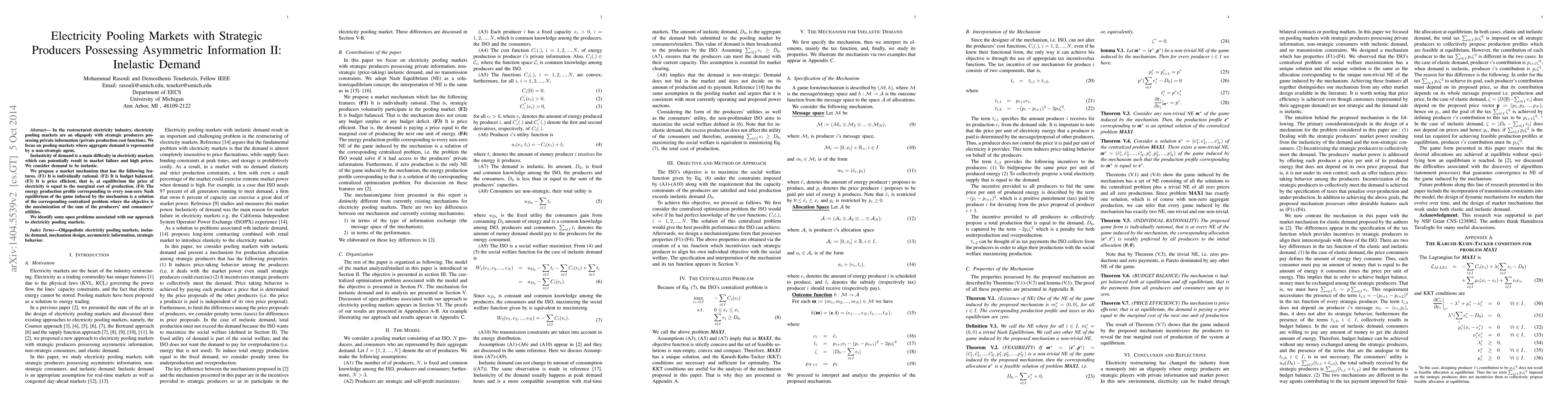

In the restructured electricity industry, electricity pooling markets are an oligopoly with strategic producers possessing private information (private production cost function). We focus on pooling markets where aggregate demand is represented by a non-strategic agent. Inelasticity of demand is a main difficulty in electricity markets which can potentially result in market failure and high prices. We consider demand to be inelastic. We propose a market mechanism that has the following features. (F1) It is individually rational. (F2) It is budget balanced. (F3) It is price efficient, that is, at equilibrium the price of electricity is equal to the marginal cost of production. (F4) The energy production profile corresponding to every non-zero Nash equilibrium of the game induced by the mechanism is a solution of the corresponding centralized problem where the objective is the maximization of the sum of the producers' and consumers' utilities. We identify some open problems associated with our approach to electricity pooling markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategic Storage Investment in Electricity Markets

Audun Botterud, Mehdi Jafari, Dongwei Zhao et al.

Battery Operations in Electricity Markets: Strategic Behavior and Distortions

Jerry Anunrojwong, Santiago R. Balseiro, Omar Besbes et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)