Authors

Summary

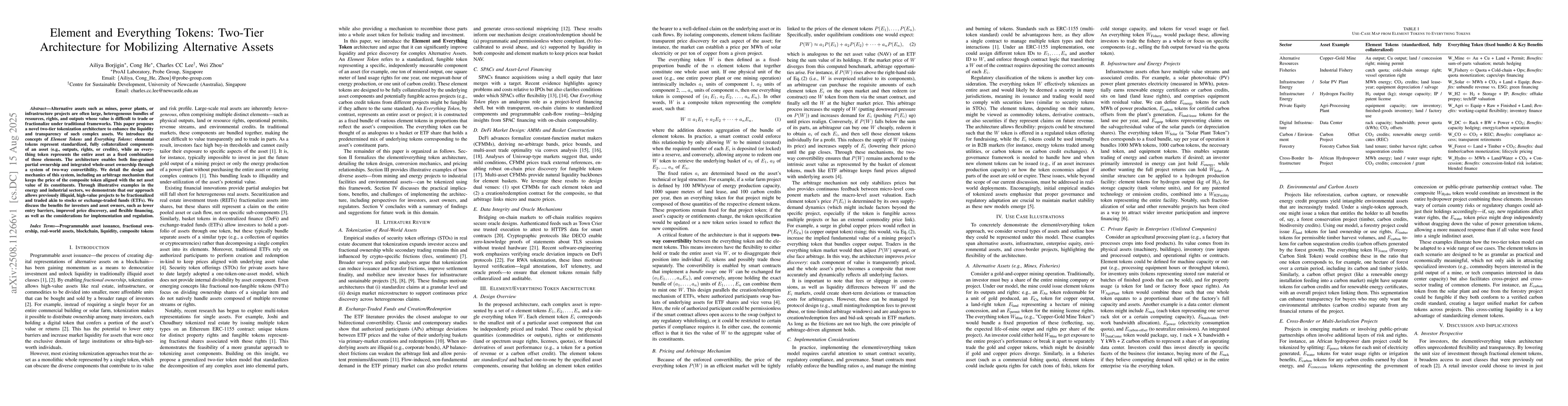

Alternative assets such as mines, power plants, or infrastructure projects are often large, heterogeneous bundles of resources, rights, and outputs whose value is difficult to trade or fractionalize under traditional frameworks. This paper proposes a novel two-tier tokenization architecture to enhance the liquidity and transparency of such complex assets. We introduce the concepts of Element Tokens and Everything Tokens: elemental tokens represent standardized, fully collateralized components of an asset (e.g., outputs, rights, or credits), while an everything token represents the entire asset as a fixed combination of those elements. The architecture enables both fine-grained partial ownership and integrated whole-asset ownership through a system of two-way convertibility. We detail the design and mechanics of this system, including an arbitrage mechanism that keeps the price of the composite token aligned with the net asset value of its constituents. Through illustrative examples in the energy and industrial sectors, we demonstrate that our approach allows previously illiquid, high-value projects to be fractionalized and traded akin to stocks or exchange-traded funds (ETFs). We discuss the benefits for investors and asset owners, such as lower entry barriers, improved price discovery, and flexible financing, as well as the considerations for implementation and regulation.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a two-tier tokenization architecture for complex alternative assets, utilizing Element Tokens and Everything Tokens, supported by smart contracts and an arbitrage mechanism for price alignment.

Key Results

- Introduces Element Tokens and Everything Tokens for standardized, collateralized components and whole asset representation, respectively.

- Demonstrates the system's ability to fractionalize illiquid, high-value projects akin to stocks or ETFs, enhancing liquidity and transparency.

- Details an arbitrage mechanism ensuring the Everything Token price remains aligned with the net asset value of its constituent Element Tokens.

- Illustrates benefits for investors and asset owners, including lower entry barriers, improved price discovery, and flexible financing.

- Discusses implementation considerations, regulatory compliance, and governance for real-world deployments.

Significance

This research is significant as it proposes a novel approach to tokenizing complex alternative assets, potentially unlocking capital by making previously untradeable aspects of assets accessible to investors and allowing asset owners to finance projects in innovative ways.

Technical Contribution

The paper presents a two-tier tokenization architecture with Element Tokens and Everything Tokens, supported by smart contracts and an arbitrage mechanism for price alignment.

Novelty

The proposed architecture differs from existing tokenization models by enabling both fine-grained partial ownership and integrated whole-asset ownership through a system of two-way convertibility, enhancing liquidity and transparency for complex alternative assets.

Limitations

- The paper does not address potential challenges in regulatory compliance across different jurisdictions.

- Implementation considerations, such as smart contract security and governance, are outlined but not tested in a real-world scenario.

- The study does not cover the impact of market volatility on token prices and liquidity.

Future Work

- Further research could focus on empirical validation of the proposed architecture through pilot projects.

- Investigating the impact of tokenization on various asset classes and market dynamics.

- Exploring integration with existing financial infrastructure and regulatory frameworks.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAI Agent Architecture for Decentralized Trading of Alternative Assets

Wei Zhou, Cong He, Ailiya Borjigin et al.

AI-Governed Agent Architecture for Web-Trustworthy Tokenization of Alternative Assets

Wei Zhou, Cong He, Ailiya Borjigin

Patents and intellectual property assets as non-fungible tokens: key technologies and challenges

Qiang Qu, Seyed Mojtaba Hosseini Bamakan, Nasim Nezhadsistani et al.

Comments (0)