Summary

This paper takes a look at the Talmudic rule aka the 1/N rule aka the uniform investment strategy from the viewpoint of elementary microeconomics. Specifically, we derive the cardinal utility function for a Talmud-obeying agent which happens to have the Cobb-Douglas form. Further, we investigate individual supply and demand due to rebalancing and compare them to market depth of an exchange. Finally, we discuss how operating as a liquidity provider can benefit the Talmud-obeying agent with every exchange transaction in terms of the identified utility function.

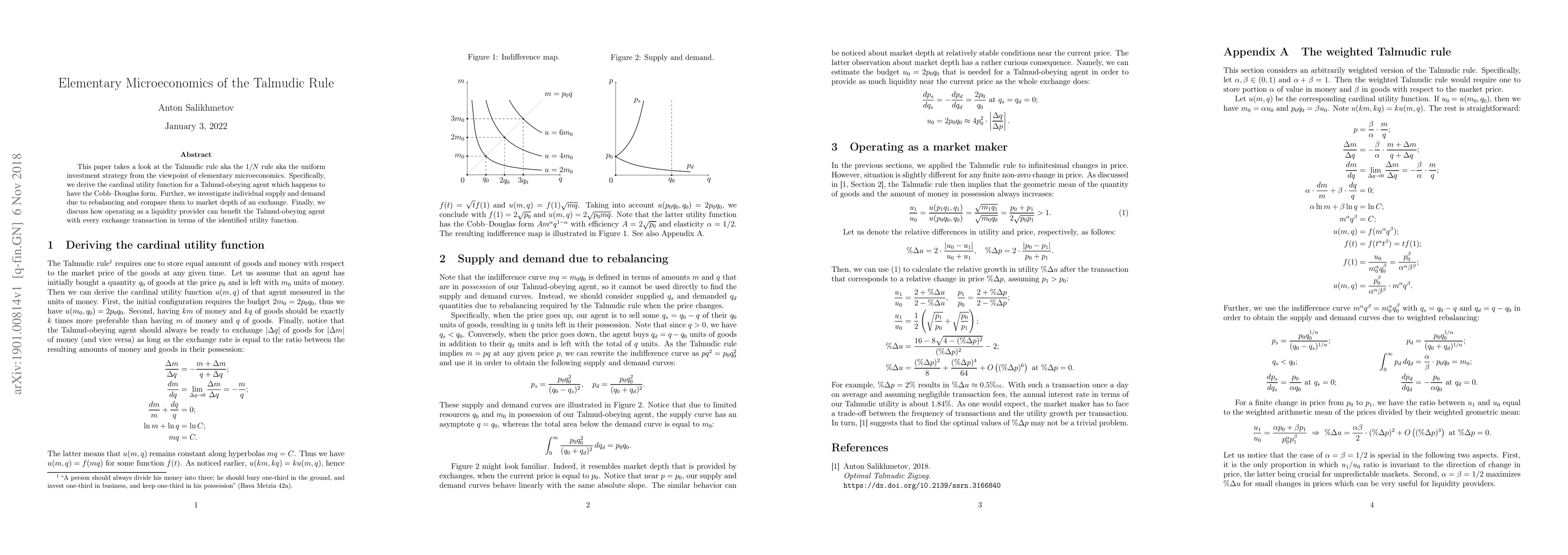

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersBTPK-based interpretable method for NER tasks based on Talmudic Public Announcement Logic

Bo Yuan, Yulin Chen, Bruno Bentzen et al.

No citations found for this paper.

Comments (0)