Summary

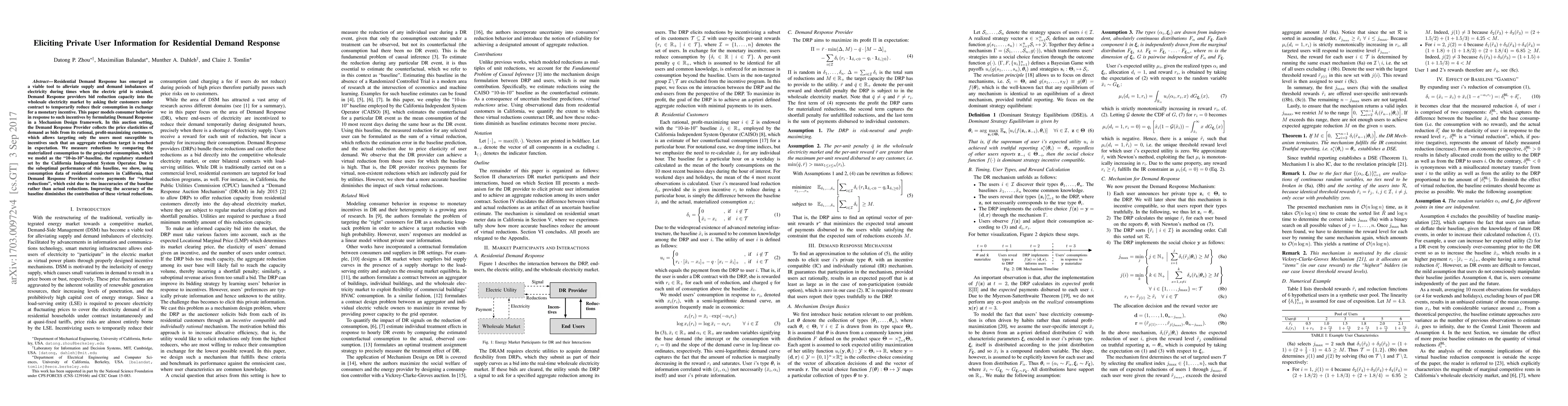

Residential Demand Response has emerged as a viable tool to alleviate supply and demand imbalances of electricity, particularly during times when the electric grid is strained due a shortage of supply. Demand Response providers bid reduction capacity into the wholesale electricity market by asking their customers under contract to temporarily reduce their consumption in exchange for a monetary incentive. To contribute to the analysis of consumer behavior in response to such incentives, this paper formulates Demand Response as a Mechanism Design problem, where a Demand Response Provider elicits private information of its rational, profit-maximizing customers who derive positive expected utility by participating in reduction events. By designing an incentive compatible and individually rational mechanism to collect users' price elasticities of demand, the Demand Response provider can target the most susceptible users to incentives. We measure reductions by comparing the materialized consumption to the projected consumption, which we model as the "10-in-10"-baseline, the regulatory standard set by the California Independent System Operator. Due to the suboptimal performance of this baseline, we show, using consumption data of residential customers in California, that Demand Response Providers receive payments for "virtual reductions", which exist due to the inaccuracies of the baseline rather than actual reductions. Improving the accuracy of the baseline diminishes the contribution of these virtual reductions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)