Authors

Summary

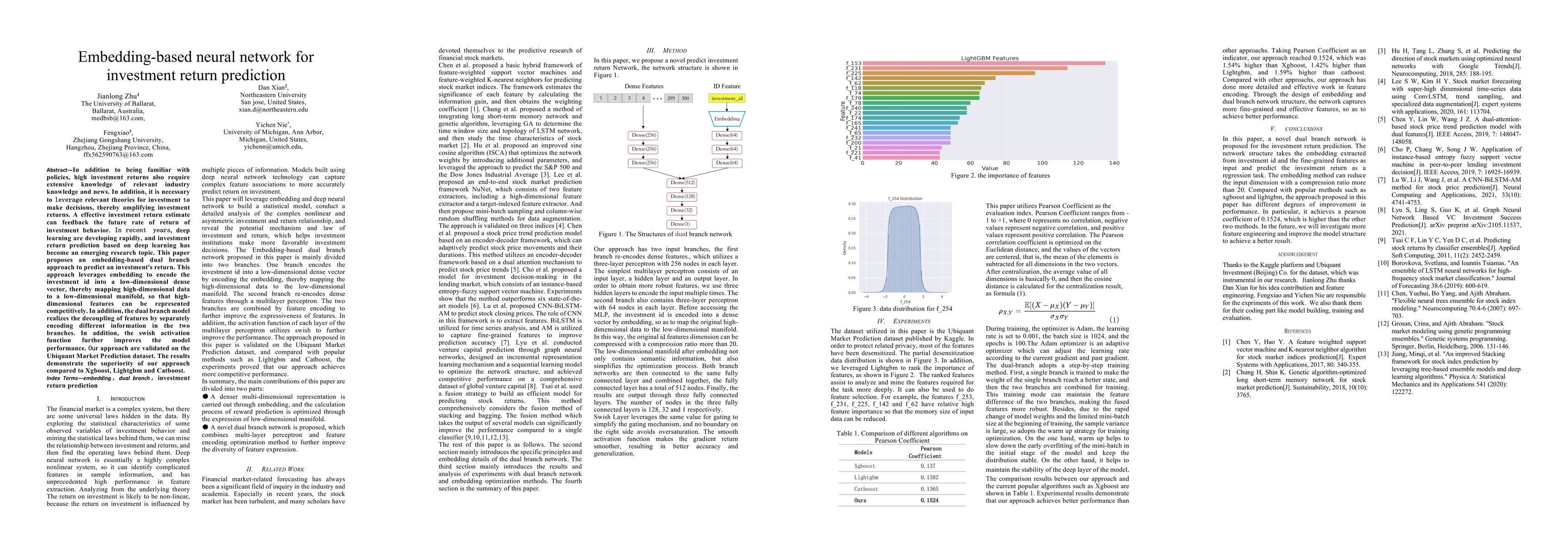

In addition to being familiar with policies, high investment returns also require extensive knowledge of relevant industry knowledge and news. In addition, it is necessary to leverage relevant theories for investment to make decisions, thereby amplifying investment returns. A effective investment return estimate can feedback the future rate of return of investment behavior. In recent years, deep learning are developing rapidly, and investment return prediction based on deep learning has become an emerging research topic. This paper proposes an embedding-based dual branch approach to predict an investment's return. This approach leverages embedding to encode the investment id into a low-dimensional dense vector, thereby mapping high-dimensional data to a low-dimensional manifold, so that highdimensional features can be represented competitively. In addition, the dual branch model realizes the decoupling of features by separately encoding different information in the two branches. In addition, the swish activation function further improves the model performance. Our approach are validated on the Ubiquant Market Prediction dataset. The results demonstrate the superiority of our approach compared to Xgboost, Lightgbm and Catboost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)