Summary

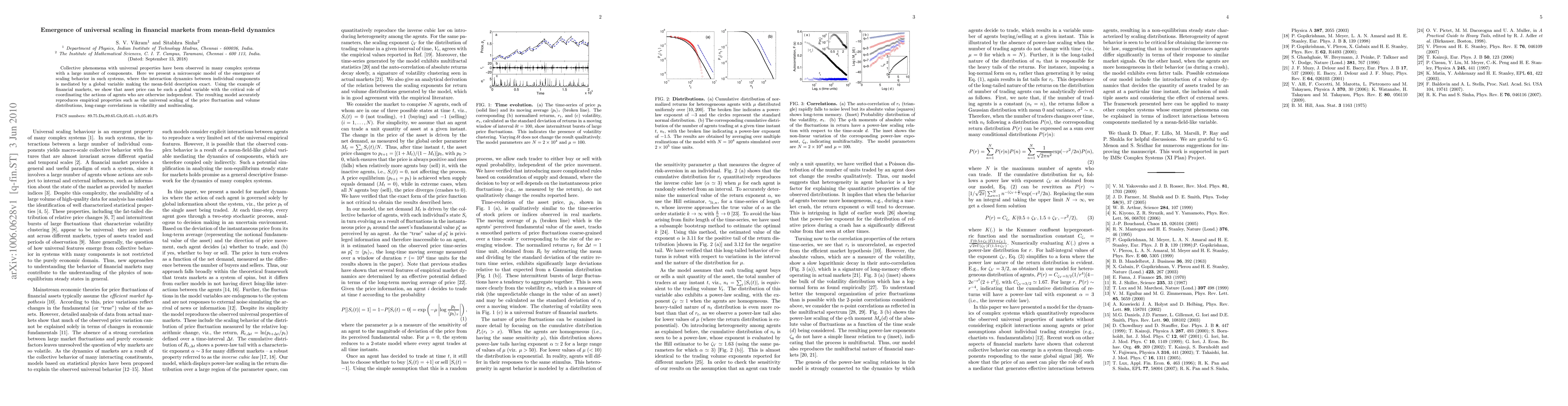

Collective phenomena with universal properties have been observed in many complex systems with a large number of components. Here we present a microscopic model of the emergence of scaling behavior in such systems, where the interaction dynamics between individual components is mediated by a global variable making the mean-field description exact. Using the example of financial markets, we show that asset price can be such a global variable with the critical role of coordinating the actions of agents who are otherwise independent. The resulting model accurately reproduces empirical properties such as the universal scaling of the price fluctuation and volume distributions, long-range correlations in volatility and multiscaling.

AI Key Findings

Generated Sep 05, 2025

Methodology

The model is based on a simple agent-based approach where each agent responds to market signals in a deterministic way.

Key Results

- The model reproduces the observed universal properties of financial markets without considering explicit interactions among agents or prior assumptions about individual trading strategies.

- The results show that heterogeneity of agent behavior is critical for obtaining the inverse cubic law.

- The model provides a new perspective on the emergence of complex systems and their emergent phenomena.

Significance

This research contributes to our understanding of financial markets and their complex behavior, providing insights into the role of individual agents in shaping market outcomes.

Technical Contribution

The model provides a new theoretical framework for understanding the emergence of complex systems in financial markets, based on direct interactions between agents mediated by a mean-field-like variable.

Novelty

This work is novel because it presents a simple and consistent explanation for the observed universal properties of financial markets, without relying on complex or ad hoc assumptions.

Limitations

- The model is highly simplified and does not capture many aspects of real-world financial markets.

- The results may not be generalizable to all types of financial markets or economic systems.

Future Work

- Extending the model to include more realistic agent behaviors and interactions.

- Investigating the role of external news and other exogenous factors in shaping market outcomes.

- Applying the model to multiple assets and financial markets to test its universality.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)