Summary

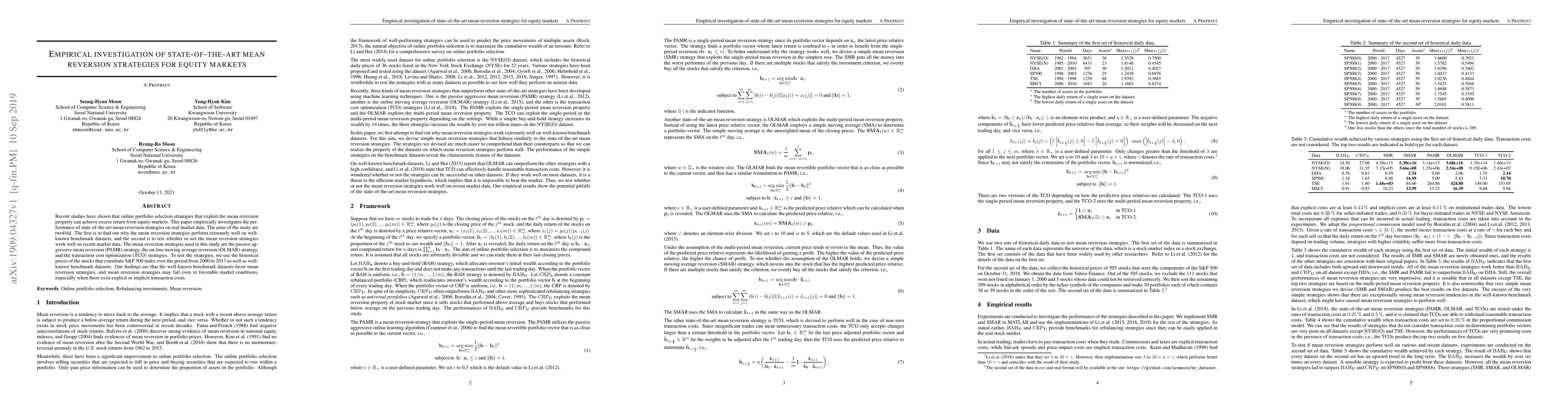

Recent studies have shown that online portfolio selection strategies that exploit the mean reversion property can achieve excess return from equity markets. This paper empirically investigates the performance of state-of-the-art mean reversion strategies on real market data. The aims of the study are twofold. The first is to find out why the mean reversion strategies perform extremely well on well-known benchmark datasets, and the second is to test whether or not the mean reversion strategies work well on recent market data. The mean reversion strategies used in this study are the passive aggressive mean reversion (PAMR) strategy, the on-line moving average reversion (OLMAR) strategy, and the transaction cost optimization (TCO) strategies. To test the strategies, we use the historical prices of the stocks that constitute S\&P 500 index over the period from 2000 to 2017 as well as well-known benchmark datasets. Our findings are that the well-known benchmark datasets favor mean reversion strategies, and mean reversion strategies may fail even in favorable market conditions, especially when there exist explicit or implicit transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)