Summary

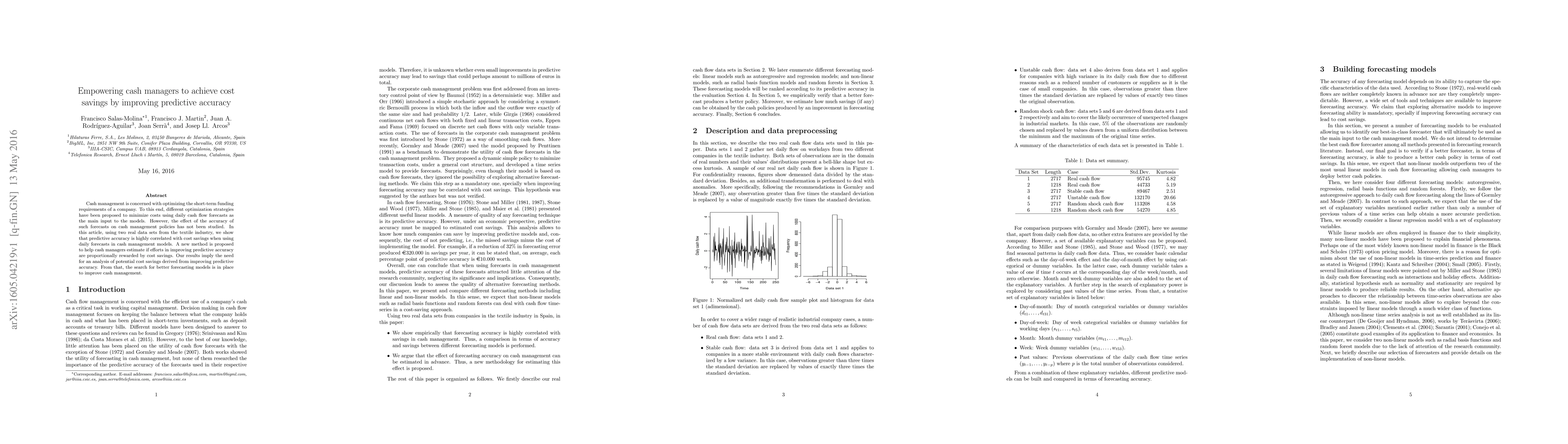

Cash management is concerned with optimizing the short-term funding requirements of a company. To this end, different optimization strategies have been proposed to minimize costs using daily cash flow forecasts as the main input to the models. However, the effect of the accuracy of such forecasts on cash management policies has not been studied. In this article, using two real data sets from the textile industry, we show that predictive accuracy is highly correlated with cost savings when using daily forecasts in cash management models. A new method is proposed to help cash managers estimate if efforts in improving predictive accuracy are proportionally rewarded by cost savings. Our results imply the need for an analysis of potential cost savings derived from improving predictive accuracy. From that, the search for better forecasting models is in place to improve cash management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIPA: Inference Pipeline Adaptation to Achieve High Accuracy and Cost-Efficiency

Lin Wang, Kamran Razavi, Saeid Ghafouri et al.

Cash or Non-Cash? Unveiling Ideators' Incentive Preferences in Crowdsourcing Contests

Christoph Riedl, Johann Füller, Katja Hutter et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)