Authors

Summary

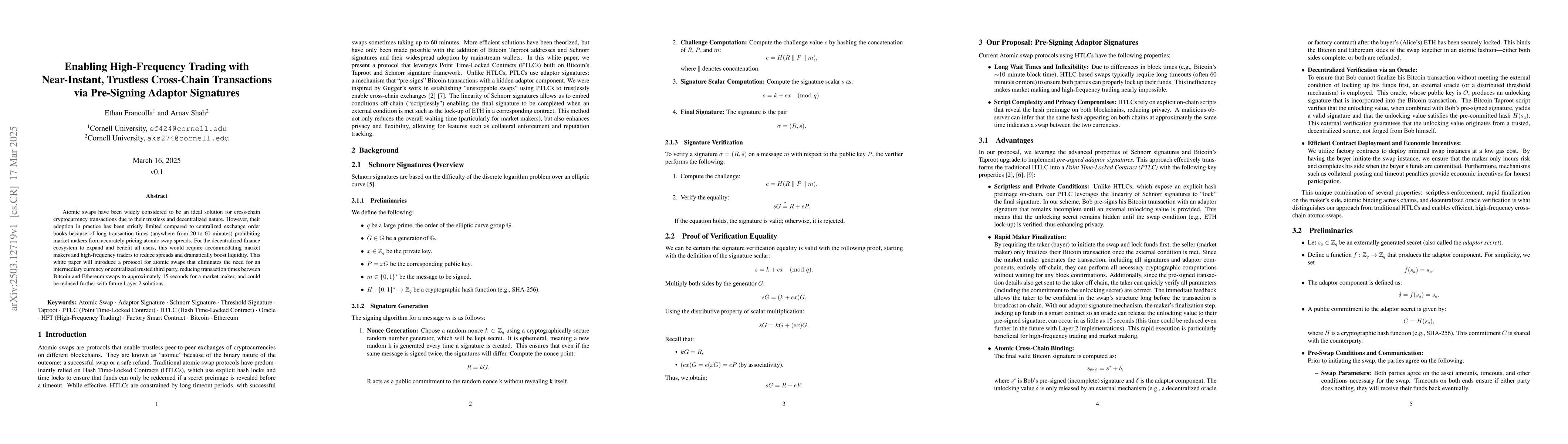

Atomic swaps have been widely considered to be an ideal solution for cross-chain cryptocurrency transactions due to their trustless and decentralized nature. However, their adoption in practice has been strictly limited compared to centralized exchange order books because of long transaction times (anywhere from 20 to 60 minutes) prohibiting market makers from accurately pricing atomic swap spreads. For the decentralized finance ecosystem to expand and benefit all users, this would require accommodating market makers and high-frequency traders to reduce spreads and dramatically boost liquidity. This white paper will introduce a protocol for atomic swaps that eliminates the need for an intermediary currency or centralized trusted third party, reducing transaction times between Bitcoin and Ethereum swaps to approximately 15 seconds for a market maker, and could be reduced further with future Layer 2 solutions.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces a protocol for atomic swaps using pre-signing adaptor signatures, eliminating the need for an intermediary currency or centralized trusted third party, reducing transaction times significantly.

Key Results

- Transaction times between Bitcoin and Ethereum swaps reduced to approximately 15 seconds for a market maker.

- A protocol for atomic swaps that does not require an intermediary currency or centralized trusted third party.

- The proposed method enables high-frequency trading (HFT) in DeFi without reliance on centralized order books.

Significance

This research is significant as it addresses key limitations of traditional HTLC-based swaps, increasing liquidity, enhancing security, and simplifying user experiences in the decentralized finance ecosystem.

Technical Contribution

The paper presents an innovative method for executing atomic swaps using pre-signed adaptor signatures built on Schnorr signatures and Bitcoin's Taproot upgrade, addressing limitations of earlier methods such as long waiting times, rigid on-chain scripting, and privacy concerns.

Novelty

The proposed method differs from existing research by enabling trustless, rapid, and decentralized asset exchanges, which could dramatically increase liquidity in the DeFi ecosystem and empower a broader range of users to swap cryptocurrencies independently.

Limitations

- The protocol's efficiency is dependent on the performance of external oracles.

- Potential risks for both parties, such as market volatility and ghosting, need careful consideration.

Future Work

- Developing a real-world code implementation and API for facilitators to easily conduct these swaps.

- Researching implementation using Layer 2 solutions like Bitcoin's Lightning Network or Ethereum's Zk-Rollups to further reduce transaction times.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMAP the Blockchain World: A Trustless and Scalable Blockchain Interoperability Protocol for Cross-chain Applications

Yang Liu, Jiannong Cao, Ruidong Li et al.

Hybrid Stabilization Protocol for Cross-Chain Digital Assets Using Adaptor Signatures and AI-Driven Arbitrage

Andrey Kuehlkamp, Jarek Nabrzyski, Shengwei You

No citations found for this paper.

Comments (0)