Summary

Reconstructing patterns of interconnections from partial information is one of the most important issues in the statistical physics of complex networks. A paramount example is provided by financial networks. In fact, the spreading and amplification of financial distress in capital markets is strongly affected by the interconnections among financial institutions. Yet, while the aggregate balance sheets of institutions are publicly disclosed, information on single positions is mostly confidential and, as such, unavailable. Standard approaches to reconstruct the network of financial interconnection produce unrealistically dense topologies, leading to a biased estimation of systemic risk. Moreover, reconstruction techniques are generally designed for monopartite networks of bilateral exposures between financial institutions, thus failing in reproducing bipartite networks of security holdings (\eg, investment portfolios). Here we propose a reconstruction method based on constrained entropy maximization, tailored for bipartite financial networks. Such a procedure enhances the traditional {\em capital-asset pricing model} (CAPM) and allows to reproduce the correct topology of the network. We test this ECAPM method on a dataset, collected by the European Central Bank, of detailed security holdings of European institutional sectors over a period of six years (2009-2015). Our approach outperforms the traditional CAPM and the recently proposed MECAPM both in reproducing the network topology and in estimating systemic risk due to fire-sales spillovers. In general, ECAPM can be applied to the whole class of weighted bipartite networks described by the fitness model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

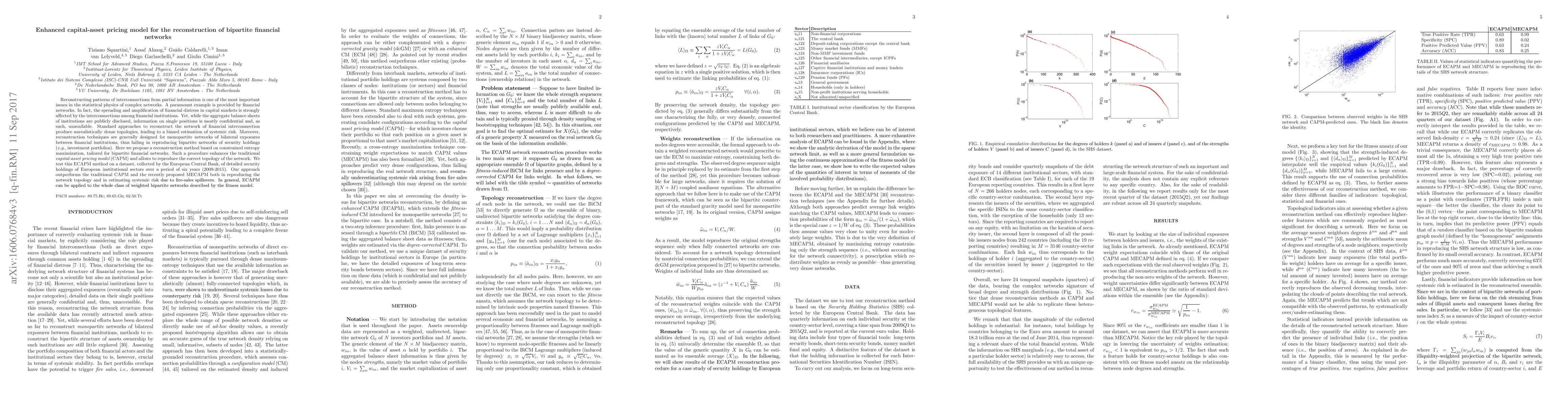

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)