Summary

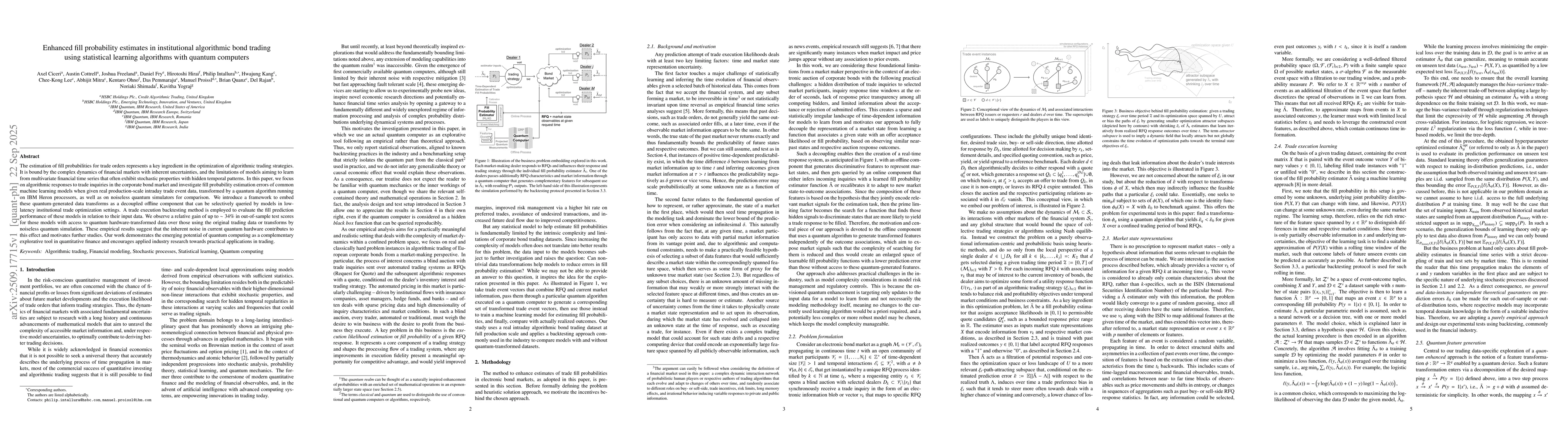

The estimation of fill probabilities for trade orders represents a key ingredient in the optimization of algorithmic trading strategies. It is bound by the complex dynamics of financial markets with inherent uncertainties, and the limitations of models aiming to learn from multivariate financial time series that often exhibit stochastic properties with hidden temporal patterns. In this paper, we focus on algorithmic responses to trade inquiries in the corporate bond market and investigate fill probability estimation errors of common machine learning models when given real production-scale intraday trade event data, transformed by a quantum algorithm running on IBM Heron processors, as well as on noiseless quantum simulators for comparison. We introduce a framework to embed these quantum-generated data transforms as a decoupled offline component that can be selectively queried by models in low-latency institutional trade optimization settings. A trade execution backtesting method is employed to evaluate the fill prediction performance of these models in relation to their input data. We observe a relative gain of up to ~ 34% in out-of-sample test scores for those models with access to quantum hardware-transformed data over those using the original trading data or transforms by noiseless quantum simulation. These empirical results suggest that the inherent noise in current quantum hardware contributes to this effect and motivates further studies. Our work demonstrates the emerging potential of quantum computing as a complementary explorative tool in quantitative finance and encourages applied industry research towards practical applications in trading.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research employed a hybrid quantum-classical approach, utilizing Heisenberg circuits on IBM quantum hardware and noiseless simulations. It combined classical trading data with quantum-generated features through event matching techniques to evaluate fill probability estimation for RFQ responses.

Key Results

- Quantum-generated features showed significant improvements in out-of-sample fill probability estimation compared to classical inputs and noiseless simulations.

- Models using quantum hardware (especially longer circuits) achieved higher AUC scores, with up to 34% performance gains over classical methods.

- Noise-induced drifts in quantum features were observed, suggesting hardware noise may influence model performance in non-trivial ways.

Significance

This work demonstrates the potential of quantum computing to enhance financial market analysis, offering new tools for algorithmic trading and risk assessment. It bridges quantum theory with practical financial applications, opening avenues for error-corrected quantum systems in real-world markets.

Technical Contribution

The paper introduces a novel classical-quantum event matching framework that enables state-dependent reuse of quantum features while maintaining label independence, combined with Heisenberg circuit-based quantum feature generation for financial time series analysis.

Novelty

This work is novel in its integration of quantum computing with financial market analysis through custom quantum circuits and event matching techniques, providing empirical evidence of quantum-enhanced trading strategies in real-world scenarios.

Limitations

- Results are data-specific and rely on heuristic methods without generalization guarantees to other market environments.

- The exact role of quantum hardware noise in performance gains remains unclear and requires further investigation.

Future Work

- Investigate the impact of different quantum noise models on feature encoding and model performance.

- Explore error-correction techniques to mitigate hardware noise effects in quantum financial applications.

- Validate findings across diverse market datasets and trading environments.

- Develop more sophisticated event matching frameworks for better temporal alignment of quantum and classical features.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAlgorithmic Trading Using Continuous Action Space Deep Reinforcement Learning

Mahdi Shamsi, Farokh Marvasti, Naseh Majidi

Comments (0)