Summary

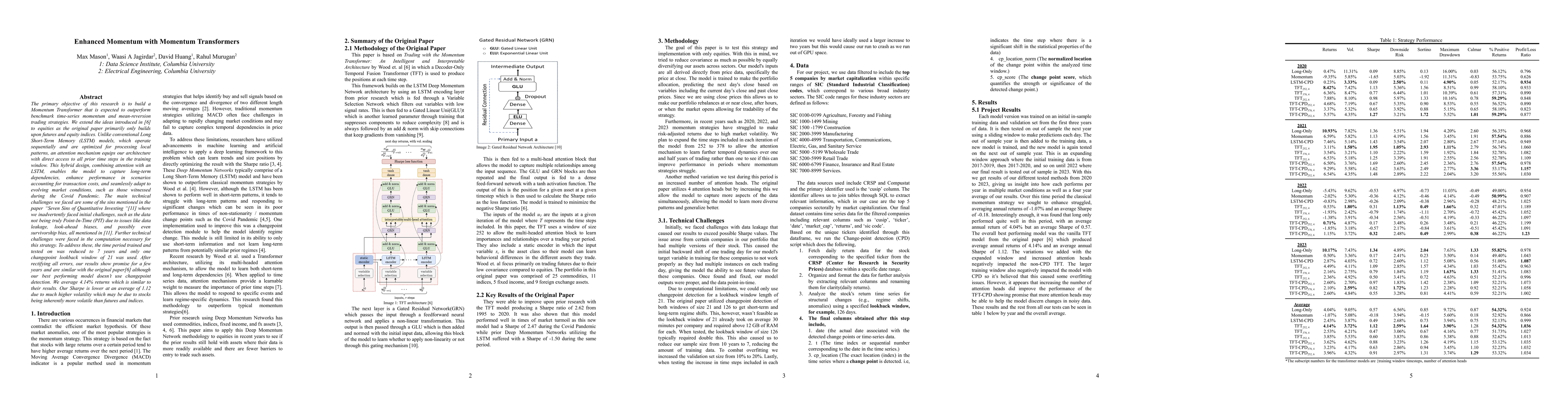

The primary objective of this research is to build a Momentum Transformer that is expected to outperform benchmark time-series momentum and mean-reversion trading strategies. We extend the ideas introduced in the paper Trading with the Momentum Transformer: An Intelligent and Interpretable Architecture to equities as the original paper primarily only builds upon futures and equity indices. Unlike conventional Long Short-Term Memory (LSTM) models, which operate sequentially and are optimized for processing local patterns, an attention mechanism equips our architecture with direct access to all prior time steps in the training window. This hybrid design, combining attention with an LSTM, enables the model to capture long-term dependencies, enhance performance in scenarios accounting for transaction costs, and seamlessly adapt to evolving market conditions, such as those witnessed during the Covid Pandemic. We average 4.14% returns which is similar to the original papers results. Our Sharpe is lower at an average of 1.12 due to much higher volatility which may be due to stocks being inherently more volatile than futures and indices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDistributed Sign Momentum with Local Steps for Training Transformers

Xin Liu, Zhi Zhang, Soummya Kar et al.

No citations found for this paper.

Comments (0)