Authors

Summary

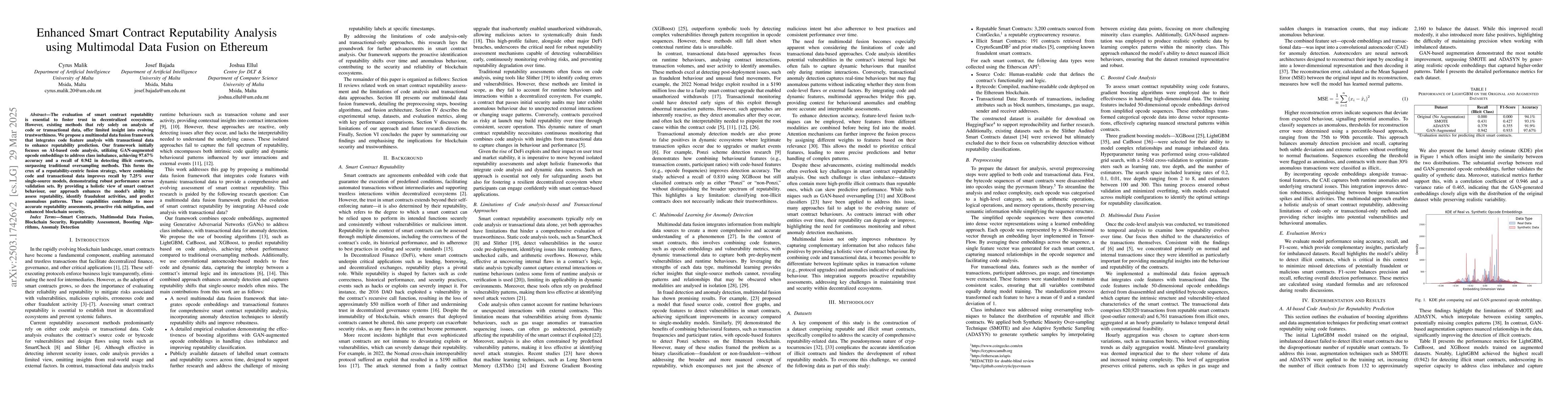

The evaluation of smart contract reputability is essential to foster trust in decentralized ecosystems. However, existing methods that rely solely on static code analysis or transactional data, offer limited insight into evolving trustworthiness. We propose a multimodal data fusion framework that integrates static code features with transactional data to enhance reputability prediction. Our framework initially focuses on static code analysis, utilizing GAN-augmented opcode embeddings to address class imbalance, achieving 97.67% accuracy and a recall of 0.942 in detecting illicit contracts, surpassing traditional oversampling methods. This forms the crux of a reputability-centric fusion strategy, where combining static and transactional data improves recall by 7.25% over single-source models, demonstrating robust performance across validation sets. By providing a holistic view of smart contract behaviour, our approach enhances the model's ability to assess reputability, identify fraudulent activities, and predict anomalous patterns. These capabilities contribute to more accurate reputability assessments, proactive risk mitigation, and enhanced blockchain security.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a multimodal data fusion framework integrating static code analysis with transactional data for smart contract reputability prediction on Ethereum. It uses GAN-augmented opcode embeddings to address class imbalance, achieving high accuracy and recall in detecting illicit contracts, surpassing traditional oversampling methods.

Key Results

- The proposed framework achieved 97.67% accuracy and 0.942 recall in detecting illicit smart contracts, outperforming traditional oversampling methods.

- Multimodal fusion improved recall by 7.25% over single-source models, demonstrating robust performance across validation sets.

- The approach enhances the model's ability to assess reputability, identify fraudulent activities, and predict anomalous patterns, contributing to more accurate reputability assessments and enhanced blockchain security.

Significance

This research is significant as it addresses the limitation of existing methods that rely solely on static code analysis or transactional data, offering limited insight into evolving trustworthiness. By providing a holistic view of smart contract behavior, it contributes to fostering trust in decentralized ecosystems.

Technical Contribution

The main technical contribution is the development of a multimodal data fusion framework that integrates static code features with transactional data, enhancing reputability prediction for smart contracts on Ethereum.

Novelty

This work is novel in its comprehensive approach to smart contract reputability analysis, combining static code analysis with dynamic transactional data, which existing methods have not fully addressed.

Limitations

- The study acknowledges the challenge of data imbalance between reputable and illicit smart contracts, which synthetic data augmentation techniques may not fully capture.

- The lack of explicit reputability labels at specific timestamps necessitates the use of proxy indicators, introducing ambiguity in interpretability and model robustness.

Future Work

- Future research could focus on acquiring richer datasets or developing advanced data augmentation methods to better capture the diversity of real-world illicit contract behaviors.

- Incorporating additional contextual signals, such as smart contract event logs or expert annotations, could enhance reputability tracking accuracy and reduce reliance on indirect indicators.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSecurity Analysis of Smart Contract Migration from Ethereum to Arbitrum

Xueyan Tang, Lingzhi Shi

On-Chain Analysis of Smart Contract Dependency Risks on Ethereum

Martin Monperrus, Raphina Liu, Monica Jin

No citations found for this paper.

Comments (0)