Authors

Summary

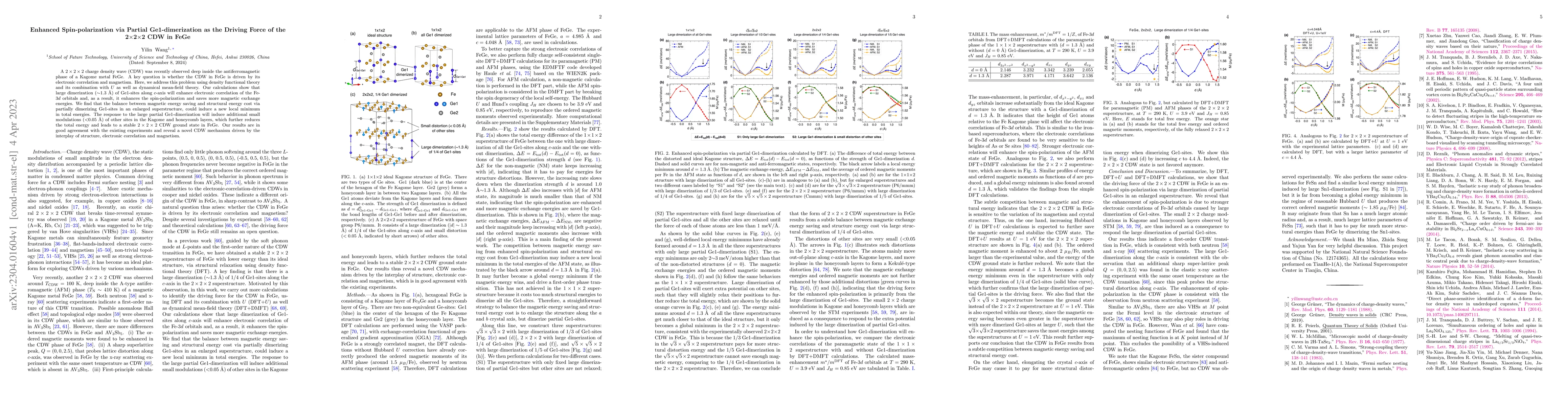

A $2\times2\times2$ charge density wave (CDW) was recently observed deep inside the antiferromagnetic phase of a Kagome metal FeGe. A key question is whether the CDW in FeGe is driven by its electronic correlation and magnetism. Here, we address this problem using density functional theory and its combination with $U$ as well as dynamical mean-field theory. Our calculations show that large dimerization ($\sim 1.3 \overset{\lower.5em\circ}{\mathrm{A}}$) of Ge1-sites along $c$-axis will enhance electronic correlation of the Fe-$3d$ orbitals and, as a result, it enhances the spin-polarization and saves more magnetic exchange energies. We find that the balance between magnetic energy saving and structural energy cost via partially dimerizing Ge1-sites in an enlarged superstructure, could induce a new local minimum in total energies. The response to the large partial Ge1-dimerization will induce additional small modulations ($<0.05 \overset{\lower.5em\circ}{\mathrm{A}}$) of other sites in the Kagome and honeycomb layers, which further reduces the total energy and leads to a stable $2\times 2\times 2$ CDW ground state in FeGe. Our results are in good agreement with the existing experiments and reveal a novel CDW mechanism driven by the interplay of structure, electronic correlation and magnetism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLong-range spin-orbital order in the spin-orbital SU(2)$\times$SU(2)$\times$U(1) model

Yang Liu, Hong-Gang Luo, Z. Y. Xie et al.

The Fascinating World of 2 $\times$ 2 $\times$ 2 Tensors: Its Geometry and Optimization Challenges

Joe Kileel, Tamara G. Kolda, Gabriel H. Brown

No citations found for this paper.

Comments (0)