Summary

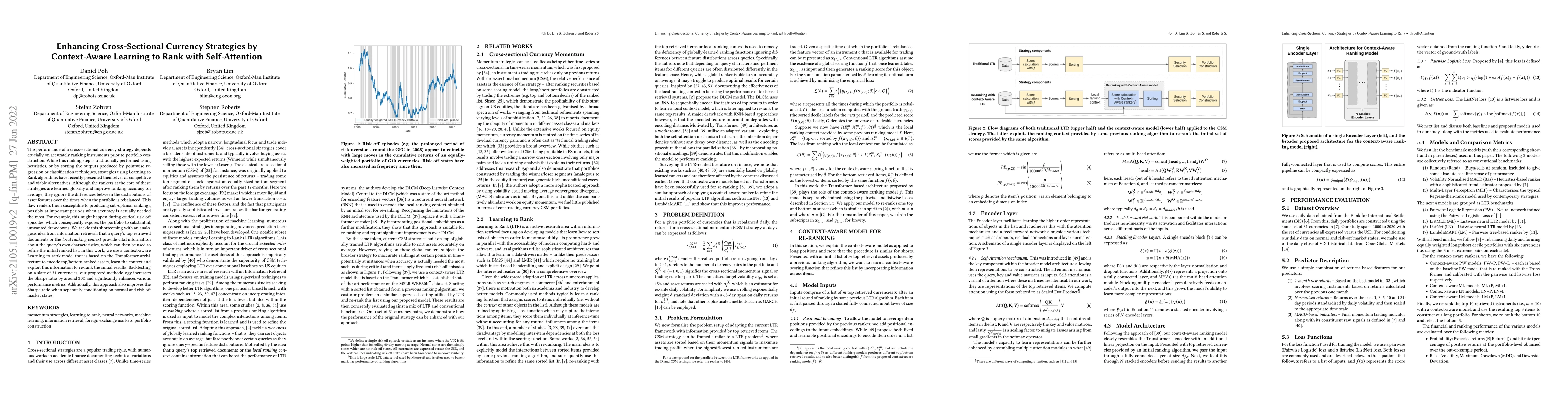

The performance of a cross-sectional currency strategy depends crucially on accurately ranking instruments prior to portfolio construction. While this ranking step is traditionally performed using heuristics, or by sorting the outputs produced by pointwise regression or classification techniques, strategies using Learning to Rank algorithms have recently presented themselves as competitive and viable alternatives. Although the rankers at the core of these strategies are learned globally and improve ranking accuracy on average, they ignore the differences between the distributions of asset features over the times when the portfolio is rebalanced. This flaw renders them susceptible to producing sub-optimal rankings, possibly at important periods when accuracy is actually needed the most. For example, this might happen during critical risk-off episodes, which consequently exposes the portfolio to substantial, unwanted drawdowns. We tackle this shortcoming with an analogous idea from information retrieval: that a query's top retrieved documents or the local ranking context provide vital information about the query's own characteristics, which can then be used to refine the initial ranked list. In this work, we use a context-aware Learning-to-rank model that is based on the Transformer architecture to encode top/bottom ranked assets, learn the context and exploit this information to re-rank the initial results. Backtesting on a slate of 31 currencies, our proposed methodology increases the Sharpe ratio by around 30% and significantly enhances various performance metrics. Additionally, this approach also improves the Sharpe ratio when separately conditioning on normal and risk-off market states.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCAMA: Enhancing Multimodal In-Context Learning with Context-Aware Modulated Attention

Ruixiang Tang, Bozheng Li, Yanshu Li et al.

Enhancing Hyperedge Prediction with Context-Aware Self-Supervised Learning

Hanghang Tong, Sang-Wook Kim, Yunyong Ko

| Title | Authors | Year | Actions |

|---|

Comments (0)