Authors

Summary

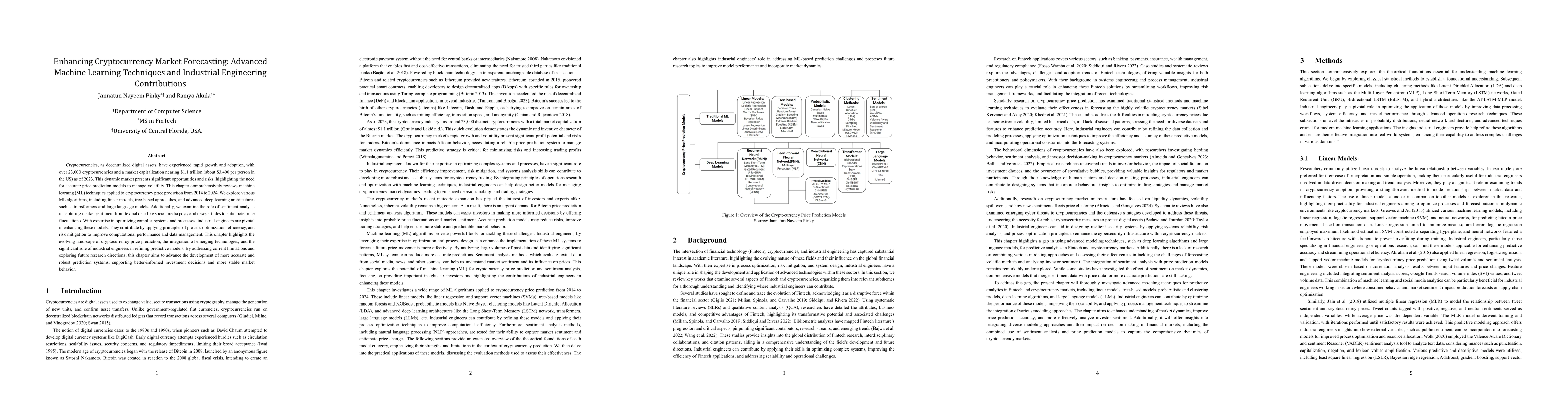

Cryptocurrencies, as decentralized digital assets, have experienced rapid growth and adoption, with over 23,000 cryptocurrencies and a market capitalization nearing \$1.1 trillion (about \$3,400 per person in the US) as of 2023. This dynamic market presents significant opportunities and risks, highlighting the need for accurate price prediction models to manage volatility. This chapter comprehensively reviews machine learning (ML) techniques applied to cryptocurrency price prediction from 2014 to 2024. We explore various ML algorithms, including linear models, tree-based approaches, and advanced deep learning architectures such as transformers and large language models. Additionally, we examine the role of sentiment analysis in capturing market sentiment from textual data like social media posts and news articles to anticipate price fluctuations. With expertise in optimizing complex systems and processes, industrial engineers are pivotal in enhancing these models. They contribute by applying principles of process optimization, efficiency, and risk mitigation to improve computational performance and data management. This chapter highlights the evolving landscape of cryptocurrency price prediction, the integration of emerging technologies, and the significant role of industrial engineers in refining predictive models. By addressing current limitations and exploring future research directions, this chapter aims to advance the development of more accurate and robust prediction systems, supporting better-informed investment decisions and more stable market behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersForecasting Cryptocurrency Prices Using Deep Learning: Integrating Financial, Blockchain, and Text Data

Stefan Lessmann, Wolfgang Karl Härdle, Vincent Gurgul

No citations found for this paper.

Comments (0)