Authors

Summary

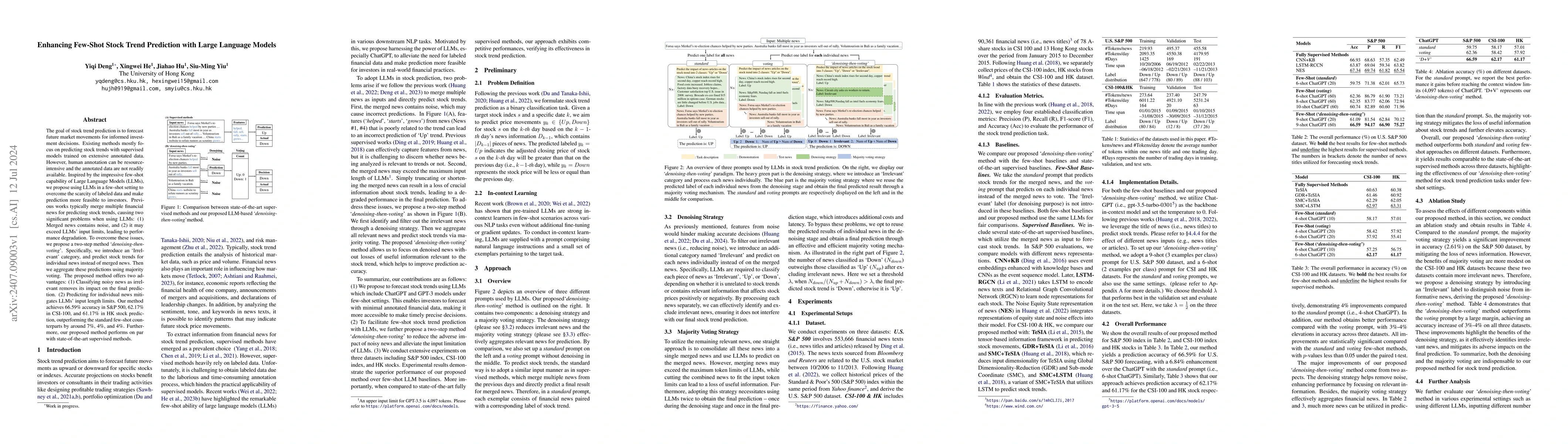

The goal of stock trend prediction is to forecast future market movements for informed investment decisions. Existing methods mostly focus on predicting stock trends with supervised models trained on extensive annotated data. However, human annotation can be resource-intensive and the annotated data are not readily available. Inspired by the impressive few-shot capability of Large Language Models (LLMs), we propose using LLMs in a few-shot setting to overcome the scarcity of labeled data and make prediction more feasible to investors. Previous works typically merge multiple financial news for predicting stock trends, causing two significant problems when using LLMs: (1) Merged news contains noise, and (2) it may exceed LLMs' input limits, leading to performance degradation. To overcome these issues, we propose a two-step method 'denoising-then-voting'. Specifically, we introduce an `Irrelevant' category, and predict stock trends for individual news instead of merged news. Then we aggregate these predictions using majority voting. The proposed method offers two advantages: (1) Classifying noisy news as irrelevant removes its impact on the final prediction. (2) Predicting for individual news mitigates LLMs' input length limits. Our method achieves 66.59% accuracy in S&P 500, 62.17% in CSI-100, and 61.17% in HK stock prediction, outperforming the standard few-shot counterparts by around 7%, 4%, and 4%. Furthermore, our proposed method performs on par with state-of-the-art supervised methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLanguage Models are Few-shot Learners for Prognostic Prediction

Zekai Chen, Kevin Brown, Mariann Micsinai Balan

Evaluating Named Entity Recognition Using Few-Shot Prompting with Large Language Models

Hédi Zhegidi, Ludovic Moncla

TabLLM: Few-shot Classification of Tabular Data with Large Language Models

David Sontag, Xiaoyi Jiang, Hunter Lang et al.

CancerGPT: Few-shot Drug Pair Synergy Prediction using Large Pre-trained Language Models

Ying Ding, Ajay Jaiswal, Tianhao Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)