Authors

Summary

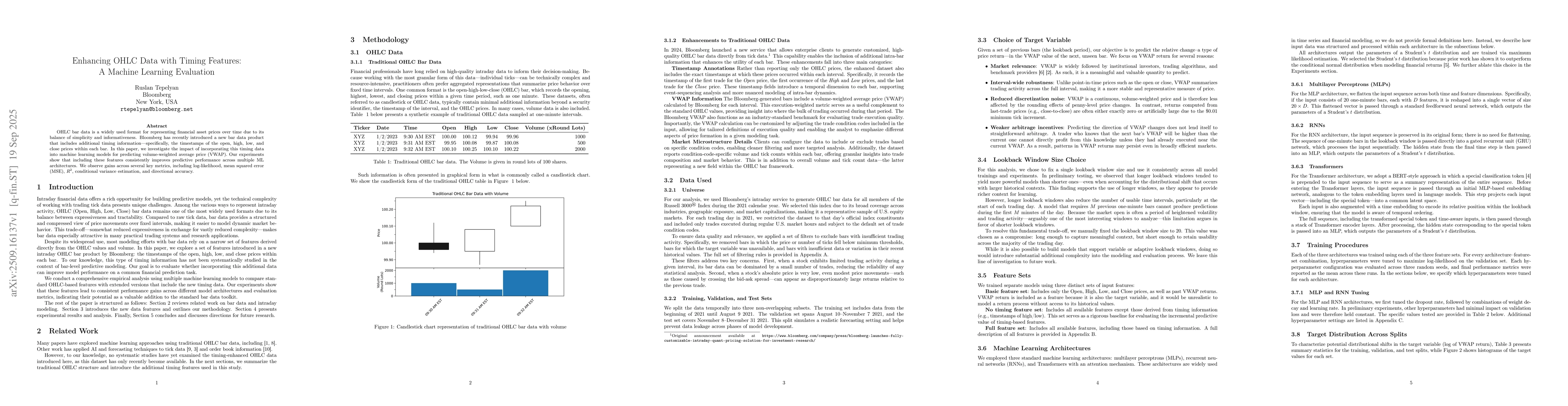

OHLC bar data is a widely used format for representing financial asset prices over time due to its balance of simplicity and informativeness. Bloomberg has recently introduced a new bar data product that includes additional timing information-specifically, the timestamps of the open, high, low, and close prices within each bar. In this paper, we investigate the impact of incorporating this timing data into machine learning models for predicting volume-weighted average price (VWAP). Our experiments show that including these features consistently improves predictive performance across multiple ML architectures. We observe gains across several key metrics, including log-likelihood, mean squared error (MSE), $R^2$, conditional variance estimation, and directional accuracy.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study evaluates machine learning models for predicting volume-weighted average price (VWAP) using OHLC data enhanced with timing features. It compares three architectures (MLP, RNN, Transformer) across three feature sets (basic, no timing, full) using metrics like NLL, MSE, R2, and directional accuracy. The models are trained and validated on different splits of the dataset, with hyperparameters tuned for optimal performance.

Key Results

- Incorporating timing features significantly improves predictive performance across all metrics (NLL, MSE, R2, directional accuracy, and conditional variance estimation).

- The Transformer model with full features achieved the lowest validation NLL (0.2442) and outperformed other models on test sets, indicating strong generalization.

- Calibration error was extremely low for all Transformer models, showing reliable uncertainty estimation, especially with full features.

Significance

This research demonstrates that timing information within OHLC bars enhances predictive accuracy for VWAP, offering practical value for algorithmic trading and financial forecasting. The findings highlight the importance of temporal context in financial data, which can improve decision-making in high-frequency trading strategies.

Technical Contribution

The paper introduces a comprehensive framework for evaluating the added value of timing information in OHLC data, with a focus on distributional predictions and uncertainty quantification using Student's t-distribution.

Novelty

The work is novel in its integration of timing features within OHLC data for VWAP prediction, and its systematic evaluation of how these features improve model performance across multiple metrics and architectures.

Limitations

- The study focuses on a specific dataset (Bloomberg's intraday data) and may not generalize to other markets or asset classes.

- Filtering rules excluded many stocks, potentially limiting the representativeness of the results.

Future Work

- Expanding the analysis to a broader range of securities and time periods.

- Exploring alternative model architectures and incorporating cross-asset correlations.

- Investigating the impact of different normalization techniques on model performance.

Paper Details

PDF Preview

Similar Papers

Found 5 papersEnhancing eLoran Timing Accuracy via Machine Learning with Meteorological and Terrain Data

Jiwon Seo, Taewon Kang, Seunghyeon Park et al.

Machine Learning Data Practices through a Data Curation Lens: An Evaluation Framework

Siyi Wu, Tegan Maharaj, Eshta Bhardwaj et al.

IoT Data Trust Evaluation via Machine Learning

Reza Arablouei, Volkan Dedeoglu, Timothy Tadj

A Machine Learning Method for Predicting Traffic Signal Timing from Probe Vehicle Data

Joseph Severino, Juliette Ugirumurera, Qichao Wang et al.

Comments (0)