Authors

Summary

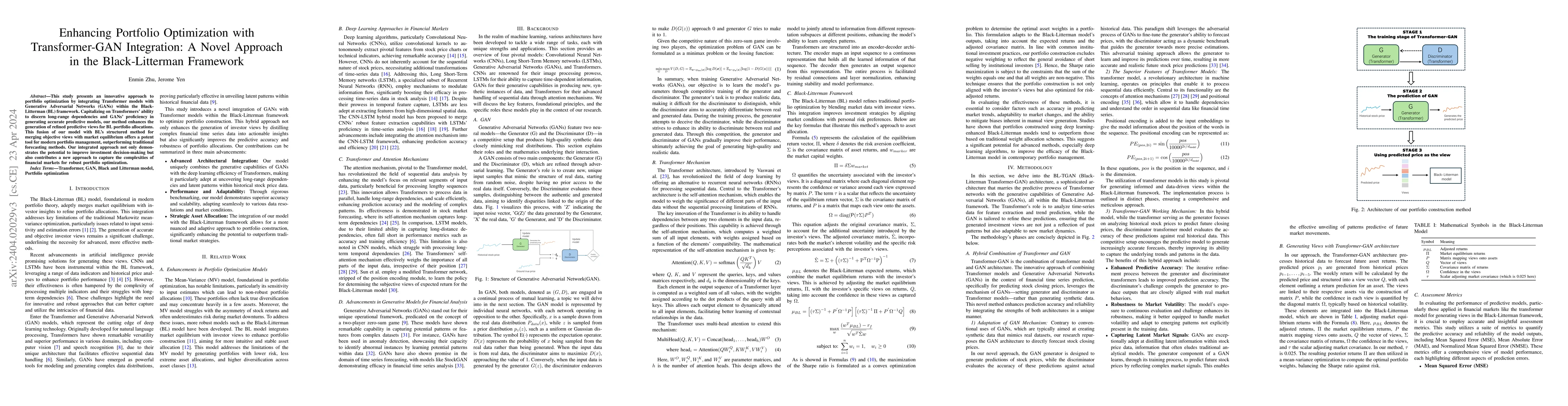

This study presents an innovative approach to portfolio optimization by integrating Transformer models with Generative Adversarial Networks (GANs) within the Black-Litterman (BL) framework. Capitalizing on Transformers' ability to discern long-range dependencies and GANs' proficiency in generating accurate predictive models, our method enhances the generation of refined predictive views for BL portfolio allocations. This fusion of our model with BL's structured method for merging objective views with market equilibrium offers a potent tool for modern portfolio management, outperforming traditional forecasting methods. Our integrated approach not only demonstrates the potential to improve investment decision-making but also contributes a new approach to capture the complexities of financial markets for robust portfolio optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Transformer based Deep Reinforcement Learning with Black-Litterman Model for Portfolio Optimization

Ruoyu Sun, Angelos Stefanidis, Jionglong Su et al.

Black-Litterman Portfolio Optimization with Noisy Intermediate-Scale Quantum Computers

Hsi-Sheng Goan, Chi-Chun Chen, San-Lin Chung

| Title | Authors | Year | Actions |

|---|

Comments (0)