Summary

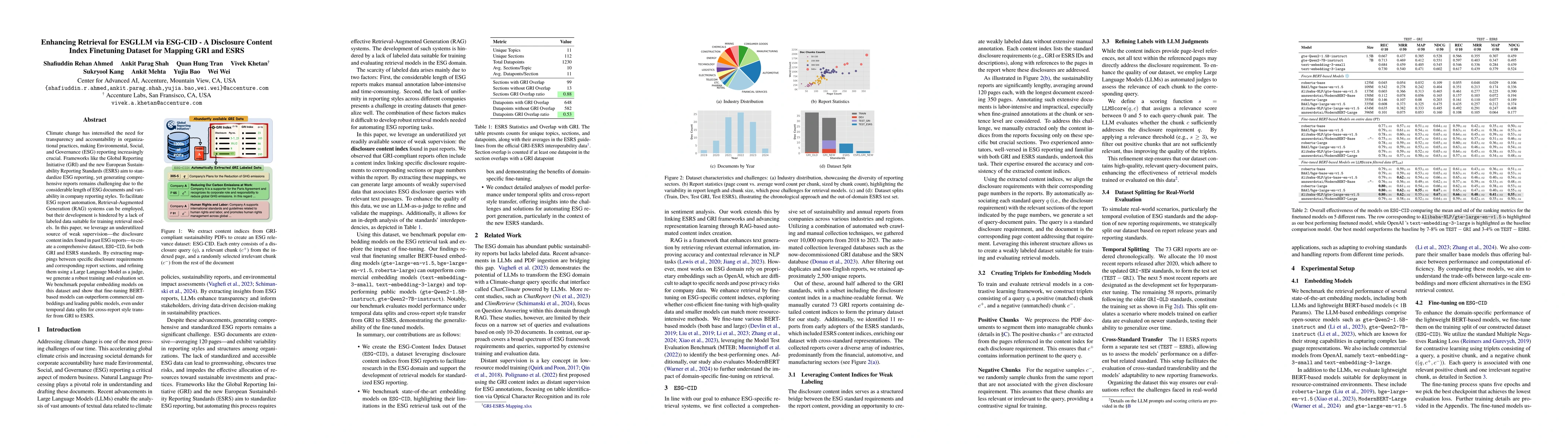

Climate change has intensified the need for transparency and accountability in organizational practices, making Environmental, Social, and Governance (ESG) reporting increasingly crucial. Frameworks like the Global Reporting Initiative (GRI) and the new European Sustainability Reporting Standards (ESRS) aim to standardize ESG reporting, yet generating comprehensive reports remains challenging due to the considerable length of ESG documents and variability in company reporting styles. To facilitate ESG report automation, Retrieval-Augmented Generation (RAG) systems can be employed, but their development is hindered by a lack of labeled data suitable for training retrieval models. In this paper, we leverage an underutilized source of weak supervision -- the disclosure content index found in past ESG reports -- to create a comprehensive dataset, ESG-CID, for both GRI and ESRS standards. By extracting mappings between specific disclosure requirements and corresponding report sections, and refining them using a Large Language Model as a judge, we generate a robust training and evaluation set. We benchmark popular embedding models on this dataset and show that fine-tuning BERT-based models can outperform commercial embeddings and leading public models, even under temporal data splits for cross-report style transfer from GRI to ESRS

AI Key Findings

Generated Jun 10, 2025

Methodology

The research leverages disclosure content indices from past ESG reports to create a comprehensive dataset, ESG-CID, for both GRI and ESRS standards. It uses a Large Language Model to refine mappings between specific disclosure requirements and report sections.

Key Results

- Fine-tuning BERT-based models on ESG-CID outperforms commercial embeddings and leading public models.

- Fine-tuned models show significant performance improvements, closing the gap and outperforming larger LLM-based embeddings.

- Fine-tuned models generalize well across evolving ESG standards, demonstrating moderate transferability despite limited ESRS-specific data.

Significance

This research highlights the practical benefits of structured indices in automating ESG reporting and compliance tasks, harmonizing GRI and ESRS frameworks, and establishing a robust foundation for future inquiries into standard-agnostic capabilities and holistic ESG reporting solutions.

Technical Contribution

Development of ESG-CID, a novel benchmark for ESG retrieval finetuning, and demonstration of its effectiveness in outperforming strong baselines such as OpenAI embeddings.

Novelty

This work is novel in its use of weak supervision from disclosure content indices to align GRI and ESRS frameworks, establishing a benchmark for ESG retrieval finetuning and showcasing the effectiveness of fine-tuned models in bootstrapping ESRS compliance with limited ESRS-specific data.

Limitations

- The dataset may lack size and diversity to fully exploit the capabilities of more complex models.

- Current work is restricted to English, limiting its applicability in the diverse linguistic landscape of ESG reporting.

Future Work

- Expand and diversify the dataset by incorporating advanced techniques for automatic content index extraction from documents and leveraging recent advancements in PDF parsing and layout analysis.

- Explore automated generation of comprehensive sustainability reports from a wide array of a company's sourced documents, including financial reports, proxy statements, and annual reports.

- Extend the work to other languages to enhance accessibility and applicability, especially given the diverse linguistic landscape of ESG reporting, particularly in Europe.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring Sustainability Intention of ESG Fund Disclosure using Few-Shot Learning

Mayank Singh, Nazia Nafis, Abhijeet Kumar et al.

FOR: Finetuning for Object Level Open Vocabulary Image Retrieval

Hila Levi, Guy Heller, Dan Levi

Adaptive Two-Phase Finetuning LLMs for Japanese Legal Text Retrieval

Vo Nguyen Le Duy, Quang Hoang Trung, Le Trung Hoang et al.

Benchmarking Multimodal Understanding and Complex Reasoning for ESG Tasks

Lei Zhang, Di Wang, Xin Zhou et al.

No citations found for this paper.

Comments (0)