Authors

Summary

In the Venture Capital(VC) industry, predicting the success of startups is challenging due to limited financial data and the need for subjective revenue forecasts. Previous methods based on time series analysis or deep learning often fall short as they fail to incorporate crucial inter-company relationships such as competition and collaboration. Regarding the issues, we propose a novel approach using GrahphRAG augmented time series model. With GraphRAG, time series predictive methods are enhanced by integrating these vital relationships into the analysis framework, allowing for a more dynamic understanding of the startup ecosystem in venture capital. Our experimental results demonstrate that our model significantly outperforms previous models in startup success predictions. To the best of our knowledge, our work is the first application work of GraphRAG.

AI Key Findings

Generated Sep 07, 2025

Methodology

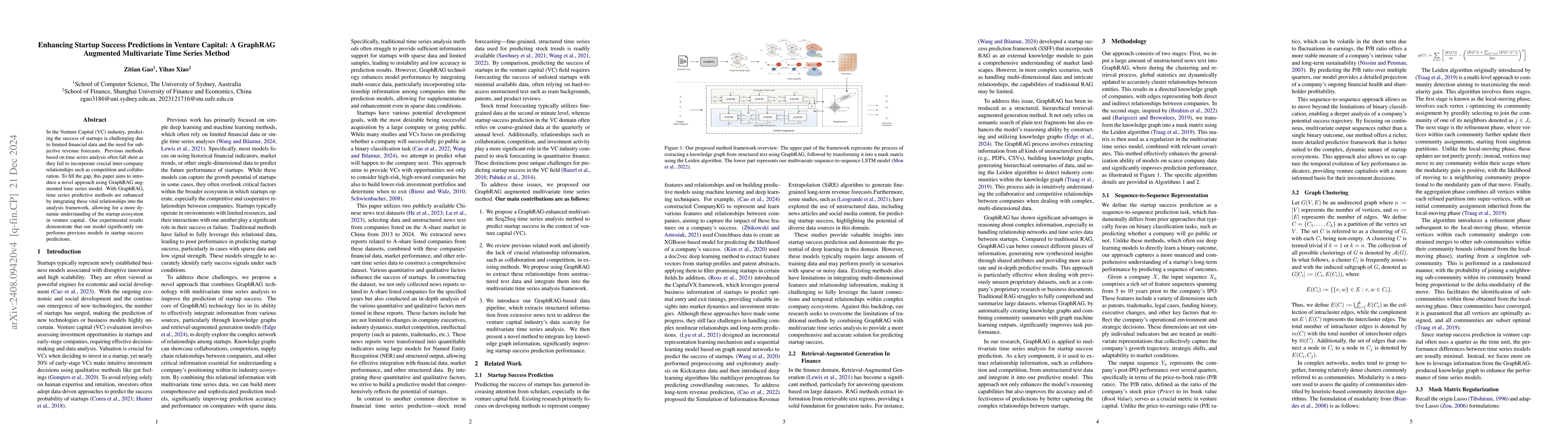

The methodology involves a two-stage process: first, unstructured news text is input into GraphRAG to create a directed knowledge graph representing relationships between entities, and second, the Leiden algorithm is applied to transform this graph into a mask matrix used as a regularizer in a multivariate time series model, enhancing its generalization ability on sparse company data.

Key Results

- GraphRAG-augmented sequence-to-sequence LSTM method outperforms baseline models by approximately 16% in R-squared value.

- The approach effectively captures complex inter-company relationships and handles sparse data conditions, leading to significantly better prediction accuracy.

Significance

This research is significant as it addresses a key issue often overlooked in previous studies: the inter-company relationships in predicting startup success in venture capital. By integrating GraphRAG with traditional time series models, it enhances reasoning, improves accuracy, and provides more accurate decision support for venture capitalists.

Technical Contribution

The paper introduces a GraphRAG-enhanced multivariate time series analysis method for predicting startup success, integrating GraphRAG with traditional time series models to leverage inter-company relationship information.

Novelty

This work is the first application of GraphRAG in the venture capital domain, significantly improving startup success prediction by addressing the limitations of previous methods that fail to incorporate crucial inter-company relationships.

Limitations

- GraphRAG's performance heavily relies on data quality, with high costs for processing unstructured text and computational challenges during indexing.

- The model's generalization beyond Chinese A-share datasets requires further validation.

Future Work

- Testing the model's performance on datasets from other countries and markets to evaluate its robustness and adaptability across different economic and cultural environments.

- Exploring different soft masking techniques to potentially enhance the model's ability to capture complex inter-company relationships.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPolicy Induction: Predicting Startup Success via Explainable Memory-Augmented In-Context Learning

Yigit Ihlamur, Fuat Alican, Joseph Ternasky et al.

Startup success prediction and VC portfolio simulation using CrunchBase data

Mark Potanin, Andrey Chertok, Konstantin Zorin et al.

A Fused Large Language Model for Predicting Startup Success

Stefan Feuerriegel, Nicolas Pröllochs, Abdurahman Maarouf

No citations found for this paper.

Comments (0)