Summary

While time series momentum is a well-studied phenomenon in finance, common strategies require the explicit definition of both a trend estimator and a position sizing rule. In this paper, we introduce Deep Momentum Networks -- a hybrid approach which injects deep learning based trading rules into the volatility scaling framework of time series momentum. The model also simultaneously learns both trend estimation and position sizing in a data-driven manner, with networks directly trained by optimising the Sharpe ratio of the signal. Backtesting on a portfolio of 88 continuous futures contracts, we demonstrate that the Sharpe-optimised LSTM improved traditional methods by more than two times in the absence of transactions costs, and continue outperforming when considering transaction costs up to 2-3 basis points. To account for more illiquid assets, we also propose a turnover regularisation term which trains the network to factor in costs at run-time.

AI Key Findings

Generated Sep 02, 2025

Methodology

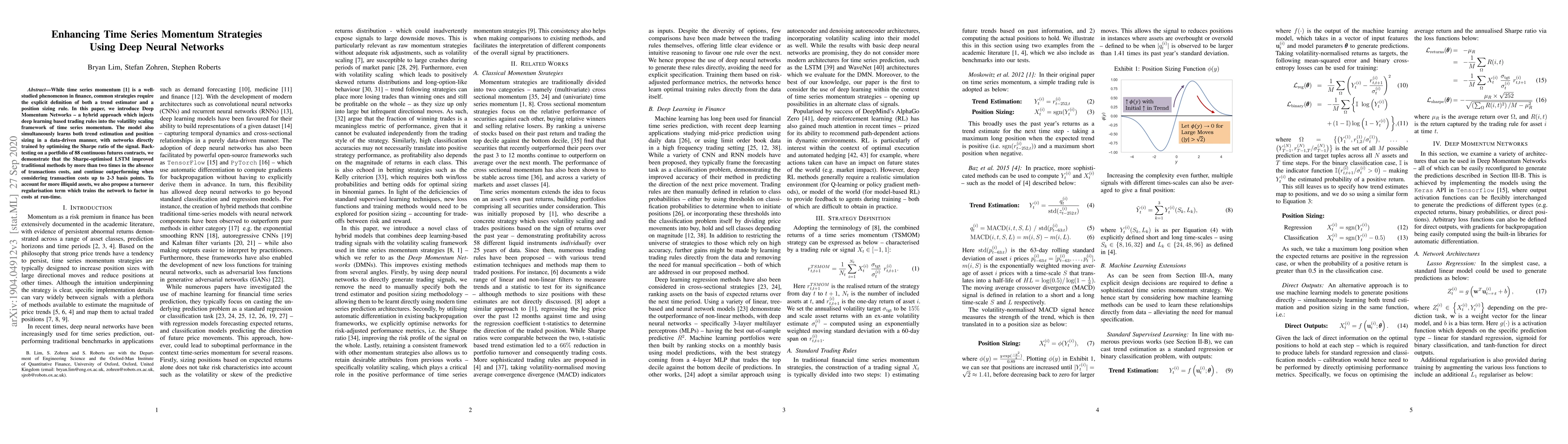

The research introduces Deep Momentum Networks, a hybrid approach that combines deep learning with volatility scaling framework of time series momentum strategies. The model learns trend estimation and position sizing simultaneously by optimizing the Sharpe ratio of the signal.

Key Results

- Deep Momentum Networks, specifically Sharpe-optimized LSTM, improved traditional time series momentum strategies by more than two times in the absence of transaction costs.

- The proposed method outperformed benchmarks when considering transaction costs up to 2-3 basis points.

- A turnover regularization term was proposed to account for more illiquid assets, enabling the network to factor in costs at runtime.

Significance

This research is significant as it enhances time series momentum strategies using deep neural networks, offering improved risk-adjusted performance and demonstrating the suitability of the Sharpe-optimized LSTM for trading more liquid assets.

Technical Contribution

The introduction of Deep Momentum Networks, which integrate deep learning models into the volatility scaling framework of time series momentum strategies, enabling simultaneous learning of trend estimation and position sizing functions.

Novelty

This work stands out by directly generating trading signals from deep neural networks, optimizing for Sharpe ratio or average strategy returns, and incorporating turnover regularization for handling transaction costs in illiquid assets.

Limitations

- The study was limited to a universe of continuous futures contracts and did not explore other asset classes.

- The impact of transaction costs was analyzed but did not consider all possible cost structures or real-world complexities.

Future Work

- Extending the framework to incorporate non-stationary data using recently introduced Recurrent Neural Filters.

- Investigating time series momentum at the microstructure level.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandomNet: Clustering Time Series Using Untrained Deep Neural Networks

Xiaosheng Li, Wenjie Xi, Jessica Lin

| Title | Authors | Year | Actions |

|---|

Comments (0)