Summary

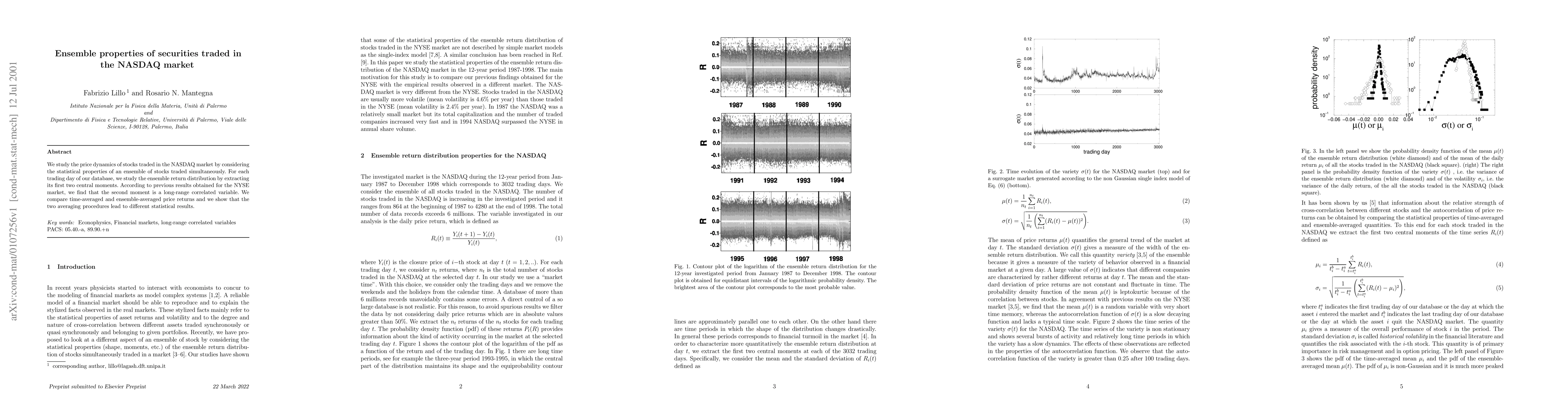

We study the price dynamics of stocks traded in the NASDAQ market by considering the statistical properties of an ensemble of stocks traded simultaneously. For each trading day of our database, we study the ensemble return distribution by extracting its first two central moments. According to previous results obtained for the NYSE market, we find that the second moment is a long-range correlated variable. We compare time-averaged and ensemble-averaged price returns and we show that the two averaging procedures lead to different statistical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamics of the securities market in the information asymmetry context: developing a methodology for emerging securities markets

Kostyantyn Anatolievich Malyshenko, Majid Mohammad Shafiee, Vadim Anatolievich Malyshenko et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)