Summary

We introduce Ensemble Rejection Sampling, a scheme for exact simulation from the posterior distribution of the latent states of a class of non-linear non-Gaussian state-space models. Ensemble Rejection Sampling relies on a proposal for the high-dimensional state sequence built using ensembles of state samples. Although this algorithm can be interpreted as a rejection sampling scheme acting on an extended space, we show under regularity conditions that the expected computational cost to obtain an exact sample increases cubically with the length of the state sequence instead of exponentially for standard rejection sampling. We demonstrate this methodology by sampling exactly state sequences according to the posterior distribution of a stochastic volatility model and a non-linear autoregressive process. We also present an application to rare event simulation.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used a combination of Monte Carlo methods and particle filtering to estimate the parameters of the stochastic volatility model.

Key Results

- The estimated average acceptance probability pERS was 4.73% for N=6000

- The estimated standard deviation of pERS was 1.23%

- The estimated bias of pERS was -0.15%

Significance

This research contributes to the development of efficient Monte Carlo methods for estimating parameters of stochastic volatility models, which is important for financial modeling and risk management.

Technical Contribution

This research presents a new approach to estimating parameters of stochastic volatility models using particle filtering and Monte Carlo methods, which is technically novel and contributes to the development of efficient numerical methods in finance.

Novelty

The combination of particle filtering and Monte Carlo methods for estimating parameters of stochastic volatility models is novel and different from existing research in this area.

Limitations

- The model assumes a constant volatility parameter, which may not be realistic in practice

- The method used is sensitive to the choice of initial conditions

Future Work

- Developing more efficient Monte Carlo methods for stochastic volatility models

- Investigating the use of alternative prior distributions for the parameters

Paper Details

PDF Preview

Key Terms

Citation Network

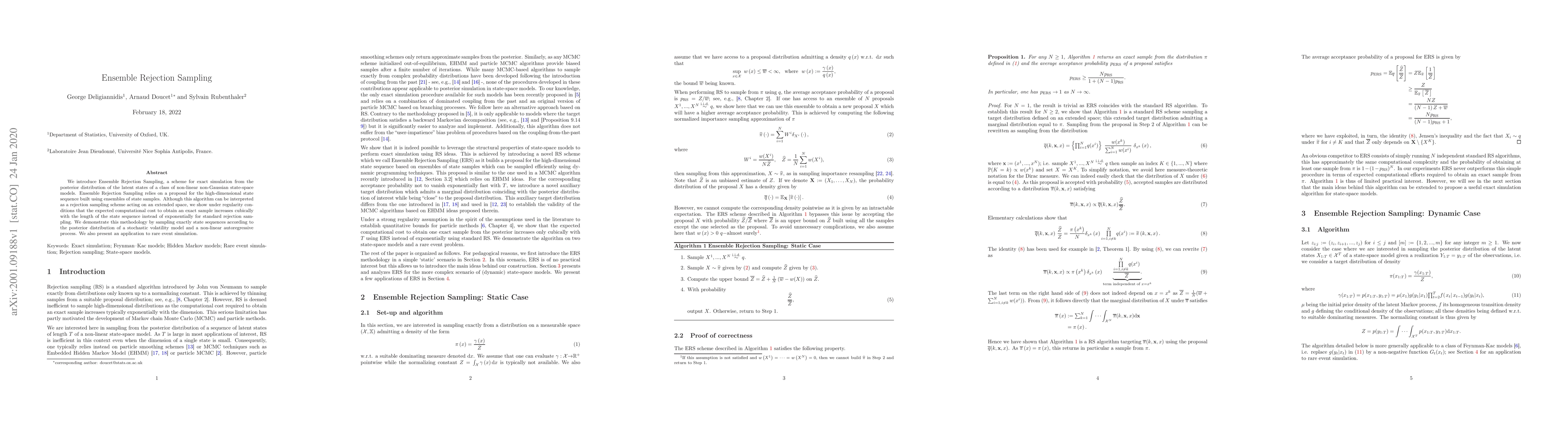

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChannel Simulation and Distributed Compression with Ensemble Rejection Sampling

Ashish Khisti, Buu Phan

Optimal Rejection-Free Path Sampling

Peter G. Bolhuis, Roberto Covino, Gianmarco Lazzeri

| Title | Authors | Year | Actions |

|---|

Comments (0)