Summary

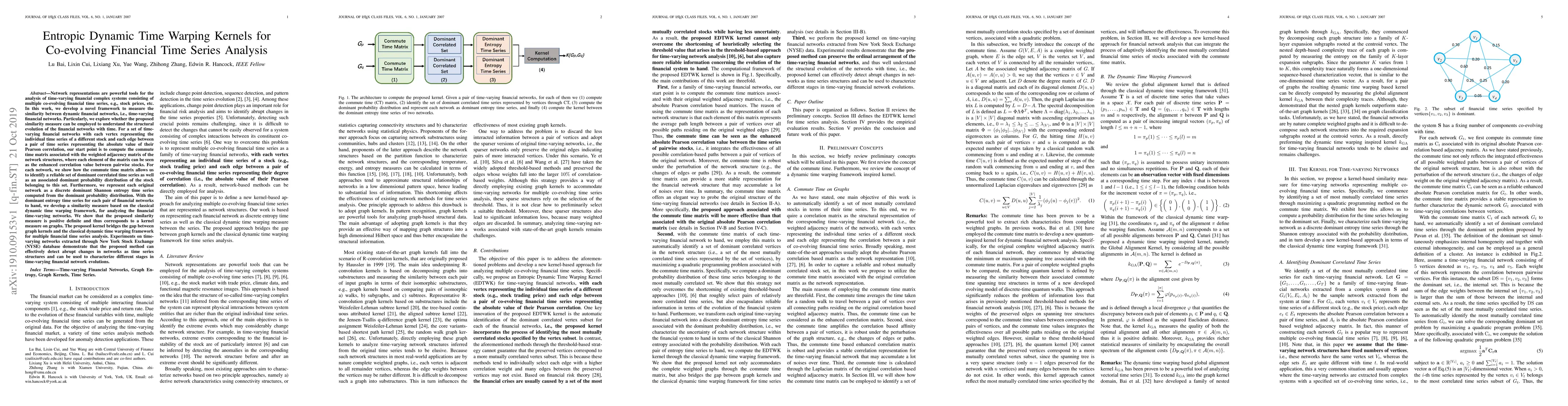

In this work, we develop a novel framework to measure the similarity between dynamic financial networks, i.e., time-varying financial networks. Particularly, we explore whether the proposed similarity measure can be employed to understand the structural evolution of the financial networks with time. For a set of time-varying financial networks with each vertex representing the individual time series of a different stock and each edge between a pair of time series representing the absolute value of their Pearson correlation, our start point is to compute the commute time matrix associated with the weighted adjacency matrix of the network structures, where each element of the matrix can be seen as the enhanced correlation value between pairwise stocks. For each network, we show how the commute time matrix allows us to identify a reliable set of dominant correlated time series as well as an associated dominant probability distribution of the stock belonging to this set. Furthermore, we represent each original network as a discrete dominant Shannon entropy time series computed from the dominant probability distribution. With the dominant entropy time series for each pair of financial networks to hand, we develop a similarity measure based on the classical dynamic time warping framework, for analyzing the financial time-varying networks. We show that the proposed similarity measure is positive definite and thus corresponds to a kernel measure on graphs. The proposed kernel bridges the gap between graph kernels and the classical dynamic time warping framework for multiple financial time series analysis. Experiments on time-varying networks extracted through New York Stock Exchange (NYSE) database demonstrate the effectiveness of the proposed approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Time Warping based Adversarial Framework for Time-Series Domain

Janardhan Rao Doppa, Yan Yan, Taha Belkhouja

Computing Continuous Dynamic Time Warping of Time Series in Polynomial Time

Sampson Wong, André Nusser, Kevin Buchin

Deep Time Warping for Multiple Time Series Alignment

Hoda Mohammadzade, Alireza Nourbakhsh

| Title | Authors | Year | Actions |

|---|

Comments (0)