Summary

Entropic risk (ERisk) is an established risk measure in finance, quantifying risk by an exponential re-weighting of rewards. We study ERisk for the first time in the context of turn-based stochastic games with the total reward objective. This gives rise to an objective function that demands the control of systems in a risk-averse manner. We show that the resulting games are determined and, in particular, admit optimal memoryless deterministic strategies. This contrasts risk measures that previously have been considered in the special case of Markov decision processes and that require randomization and/or memory. We provide several results on the decidability and the computational complexity of the threshold problem, i.e. whether the optimal value of ERisk exceeds a given threshold. In the most general case, the problem is decidable subject to Shanuel's conjecture. If all inputs are rational, the resulting threshold problem can be solved using algebraic numbers, leading to decidability via a polynomial-time reduction to the existential theory of the reals. Further restrictions on the encoding of the input allow the solution of the threshold problem in NP$\cap$coNP. Finally, an approximation algorithm for the optimal value of ERisk is provided.

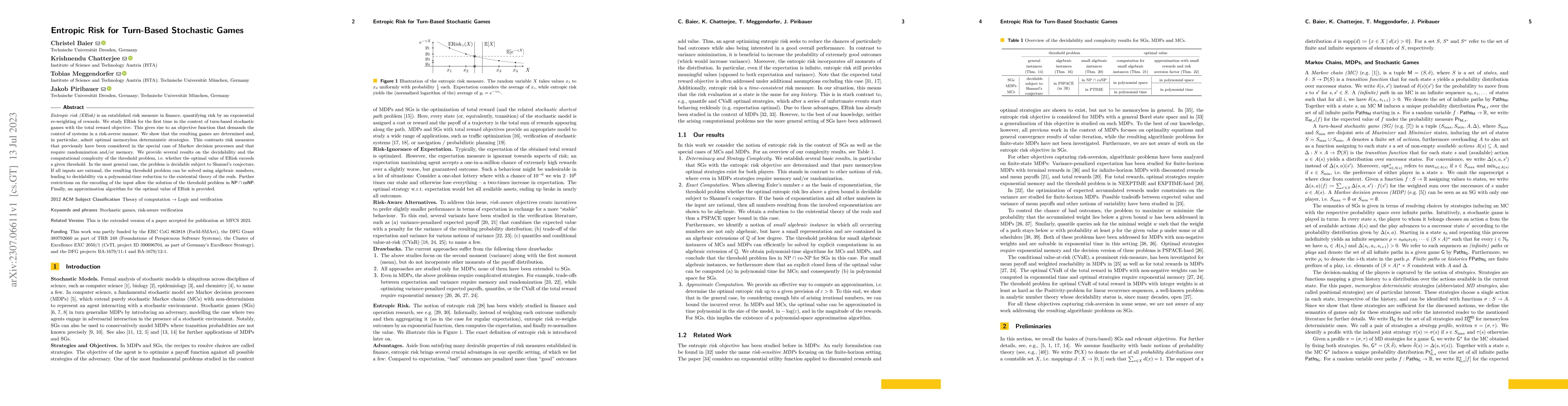

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSymbolic Verification and Strategy Synthesis for Turn-based Stochastic Games

Marta Kwiatkowska, David Parker, Gabriel Santos et al.

On the Global Convergence of Stochastic Fictitious Play in Stochastic Games with Turn-based Controllers

Muhammed O. Sayin

Efficiently Solving Turn-Taking Stochastic Games with Extensive-Form Correlation

Vincent Conitzer, Yu Cheng, Hanrui Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)