Summary

Short-term patterns in financial time series form the cornerstone of many algorithmic trading strategies, yet extracting these patterns reliably from noisy market data remains a formidable challenge. In this paper, we propose an entropy-assisted framework for identifying high-quality, non-overlapping patterns that exhibit consistent behavior over time. We ground our approach in the premise that historical patterns, when accurately clustered and pruned, can yield substantial predictive power for short-term price movements. To achieve this, we incorporate an entropy-based measure as a proxy for information gain. Patterns that lead to high one-sided movements in historical data, yet retain low local entropy, are more informative in signaling future market direction. Compared to conventional clustering techniques such as K-means and Gaussian Mixture Models (GMM), which often yield biased or unbalanced groupings, our approach emphasizes balance over a forced visual boundary, ensuring that quality patterns are not lost due to over-segmentation. By emphasizing both predictive purity (low local entropy) and historical profitability, our method achieves a balanced representation of Buy and Sell patterns, making it better suited for short-term algorithmic trading strategies.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes an entropy-assisted framework for identifying high-quality, non-overlapping patterns in financial time series data. It uses an entropy-based measure as a proxy for information gain, emphasizing balance and historical profitability over forced visual boundaries.

Key Results

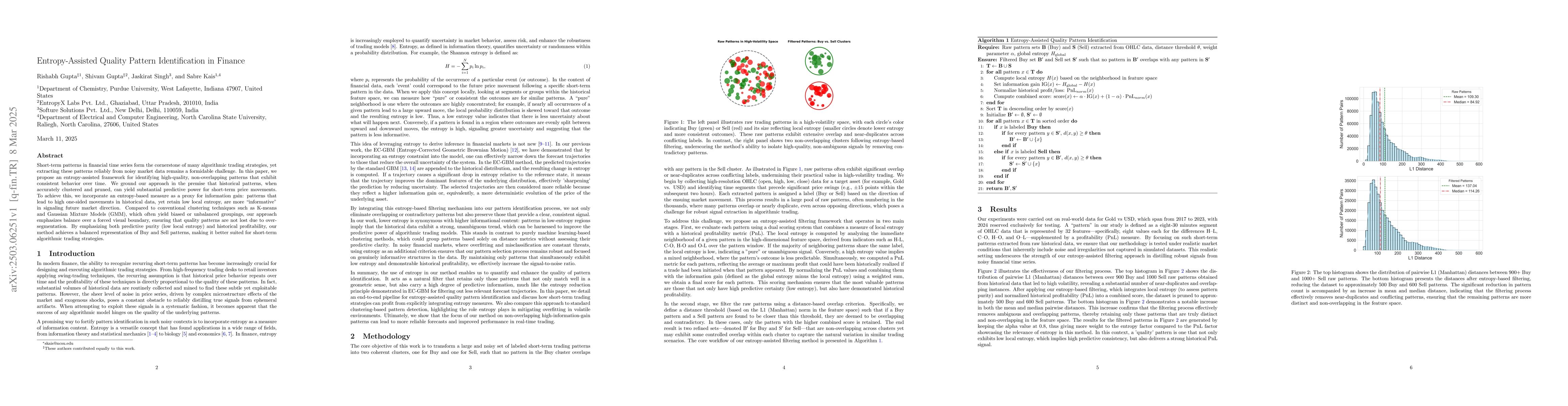

- The entropy-assisted method effectively filters raw, noisy patterns, reducing their count from thousands to approximately 500 Buy and 600 Sell patterns while increasing the average pairwise distance between patterns.

- The approach maintains a balanced Buy-Sell ratio and preserves distinct, non-overlapping patterns in the feature space, unlike traditional clustering methods like K-means and GMM that often yield biased or unbalanced clusters.

- The method consistently generated profits (30% to 60% annual returns) in a real-world trading scenario, demonstrating adaptability to varying market conditions and the impact of risk-reward trade-offs.

Significance

This research is significant as it provides a systematic, quantitative framework for transforming raw, noisy short-term trading patterns into high-quality, non-overlapping clusters suitable for algorithmic trading applications, especially in volatile market conditions.

Technical Contribution

The paper introduces an entropy-assisted pattern identification framework that prioritizes low-entropy patterns with high outcome consistency while incorporating profitability metrics, resulting in a more balanced and informative set of trading signals.

Novelty

This work differs from existing research by emphasizing a balanced and interpretable representation of market signals through an entropy-based approach, avoiding the pitfalls of traditional clustering methods that often produce imbalanced or biased clusters.

Limitations

- The study is limited to the Gold vs USD dataset from 2017 to 2023, with 2024 reserved for testing, which may restrict the generalizability of findings to other assets or markets.

- The method's performance may vary with different pattern definitions or feature engineering approaches.

Future Work

- Extending the methodology to a broader range of assets and markets to validate its generalizability and robustness.

- Incorporating real-time adaptive mechanisms to update the pattern library based on incoming data for improved algorithmic trading system performance.

- Exploring hybrid models that combine entropy-based filtering with machine learning approaches for even more refined predictive signals.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImage Quality Assessment for Foliar Disease Identification (AgroPath)

Nisar Ahmed, Hafiz Muhammad Shahzad Asif, Gulshan Saleem et al.

Diffusion-based Method for Satellite Pattern-of-Life Identification

Xiaoyu Chen, Yongchao Ye, Xinting Zhu et al.

No citations found for this paper.

Comments (0)