Authors

Summary

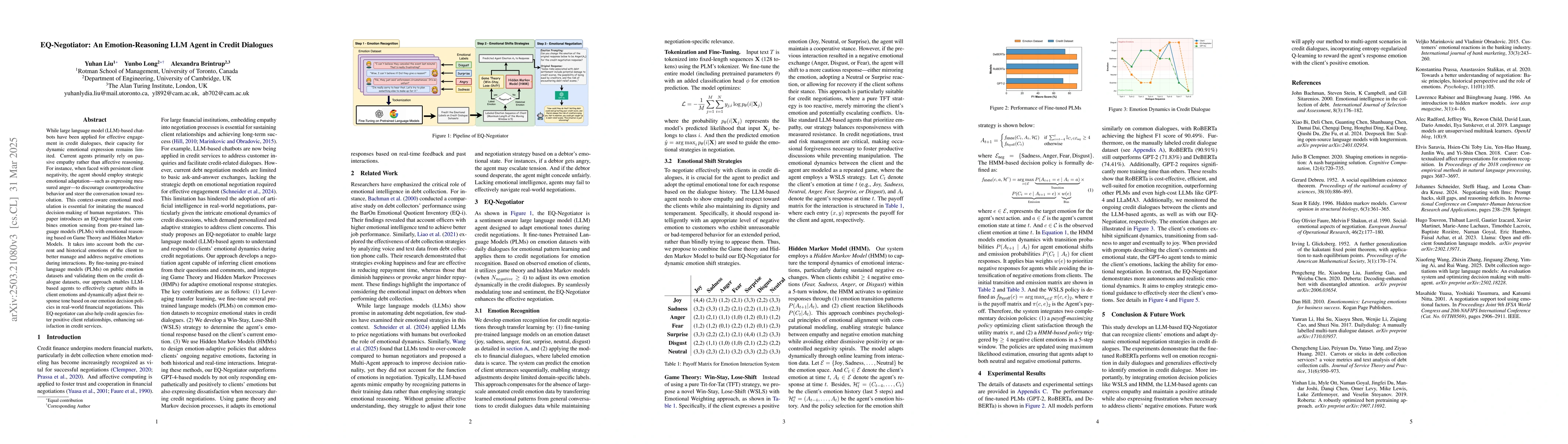

While large language model (LLM)-based chatbots have been applied for effective engagement in credit dialogues, their capacity for dynamic emotional expression remains limited. Current agents primarily rely on passive empathy rather than affective reasoning. For instance, when faced with persistent client negativity, the agent should employ strategic emotional adaptation by expressing measured anger to discourage counterproductive behavior and guide the conversation toward resolution. This context-aware emotional modulation is essential for imitating the nuanced decision-making of human negotiators. This paper introduces an EQ-negotiator that combines emotion sensing from pre-trained language models (PLMs) with emotional reasoning based on Game Theory and Hidden Markov Models. It takes into account both the current and historical emotions of the client to better manage and address negative emotions during interactions. By fine-tuning pre-trained language models (PLMs) on public emotion datasets and validating them on the credit dialogue datasets, our approach enables LLM-based agents to effectively capture shifts in client emotions and dynamically adjust their response tone based on our emotion decision policies in real-world financial negotiations. This EQ-negotiator can also help credit agencies foster positive client relationships, enhancing satisfaction in credit services.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces EQ-Negotiator, an LLM agent that combines emotion sensing from pre-trained language models (PLMs) with emotional reasoning based on Game Theory and Hidden Markov Models (HMMs) to manage client emotions in credit dialogues.

Key Results

- Fine-tuned RoBERTa achieved the highest F1-score of 90.49% on common dialogues, outperforming GPT-2 and DeBERTa.

- RoBERTa still outperformed GPT-2 (71.83%) and DeBERTa (74.41%) on the manually labeled credit dialogue dataset, demonstrating its suitability for emotion recognition.

- EQ-Negotiator showed more autonomous and realistic emotional dynamics compared to a general LLM-based agent, effectively steering client emotions through strategic emotional guidance.

Significance

This research is significant as it develops an LLM-based EQ-Negotiator capable of recognizing clients' emotions and adapting dynamic emotional negotiation strategies in credit dialogues, potentially improving client relationships and satisfaction in credit services.

Technical Contribution

The EQ-Negotiator integrates payoff-maximizing and HMM-based decision policies, enabling LLM-based agents to express empathy and maintain a positive attitude while also expressing necessary frustration to address clients' negative emotions.

Novelty

The proposed EQ-Negotiator combines emotion sensing from PLMs with emotional reasoning based on Game Theory and HMMs, offering a novel approach to dynamic emotional negotiation strategies in credit dialogues, unlike existing empathetic LLM-based agents that prioritize empathy without measured resistance.

Limitations

- The study did not explore the application of the EQ-Negotiator in multi-agent scenarios within credit dialogues.

- The emotional shift strategies were limited to Win-Stay, Lose-Shift (WSLS) and HMMs, without investigating other potential approaches.

Future Work

- Apply the method to multi-agent scenarios in credit dialogues, incorporating entropy-regularized Q-learning to reward the agent's emotional response aligned with the client's positive emotion.

- Investigate the integration of additional emotional regulation strategies beyond WSLS and HMMs to enhance the agent's adaptability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThink out Loud: Emotion Deducing Explanation in Dialogues

Jie Zhou, Qingyi Si, Zheng Lin et al.

Exploring Design of Multi-Agent LLM Dialogues for Research Ideation

Kosuke Takahashi, Takahiro Omi, Kosuke Arima et al.

VinePPO: Unlocking RL Potential For LLM Reasoning Through Refined Credit Assignment

Nicolas Le Roux, Alessandro Sordoni, Siva Reddy et al.

No citations found for this paper.

Comments (0)