Summary

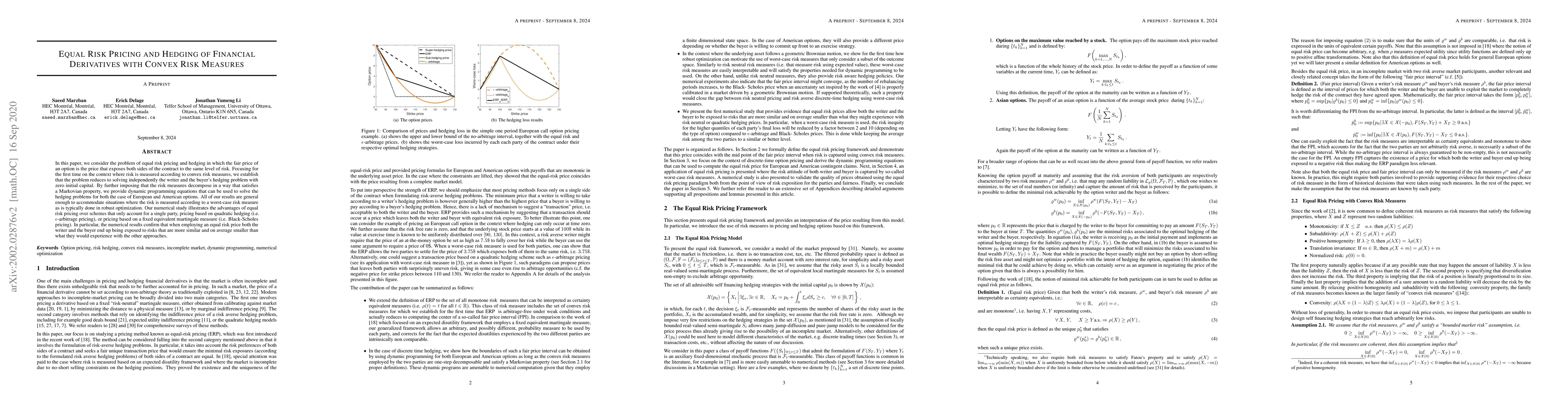

In this paper, we consider the problem of equal risk pricing and hedging in which the fair price of an option is the price that exposes both sides of the contract to the same level of risk. Focusing for the first time on the context where risk is measured according to convex risk measures, we establish that the problem reduces to solving independently the writer and the buyer's hedging problem with zero initial capital. By further imposing that the risk measures decompose in a way that satisfies a Markovian property, we provide dynamic programming equations that can be used to solve the hedging problems for both the case of European and American options. All of our results are general enough to accommodate situations where the risk is measured according to a worst-case risk measure as is typically done in robust optimization. Our numerical study illustrates the advantages of equal risk pricing over schemes that only account for a single party, pricing based on quadratic hedging (i.e. $\epsilon$-arbitrage pricing), or pricing based on a fixed equivalent martingale measure (i.e. Black-Scholes pricing). In particular, the numerical results confirm that when employing an equal risk price both the writer and the buyer end up being exposed to risks that are more similar and on average smaller than what they would experience with the other approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)