Summary

The registration, transfer, clearing and settlement of equities represents a significant part of economic activity currently underserved by modern technological innovation. In addition, recent events have revealed problems of transparency, inviting public criticism and scrutiny from regulatory authorities. A peer-to-peer platform facilitating the creation and exchange of directly registered shares represents a shift in equity markets towards more efficient, transparent operations as well as greater accessibility to the investing public and issuing companies. Blockchain technology solves the problem of transaction processing and clearing but the fungibility of their units pose a challenge in identifying the issuers and holders of specific equities. Furthermore, as the issuers are in a constant state of flux the benefits of a decentralized network are lost if a central manager is required to cancel equities from companies that no longer exist. We propose a solution to these problems using digital signatures, based on blockchain technology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

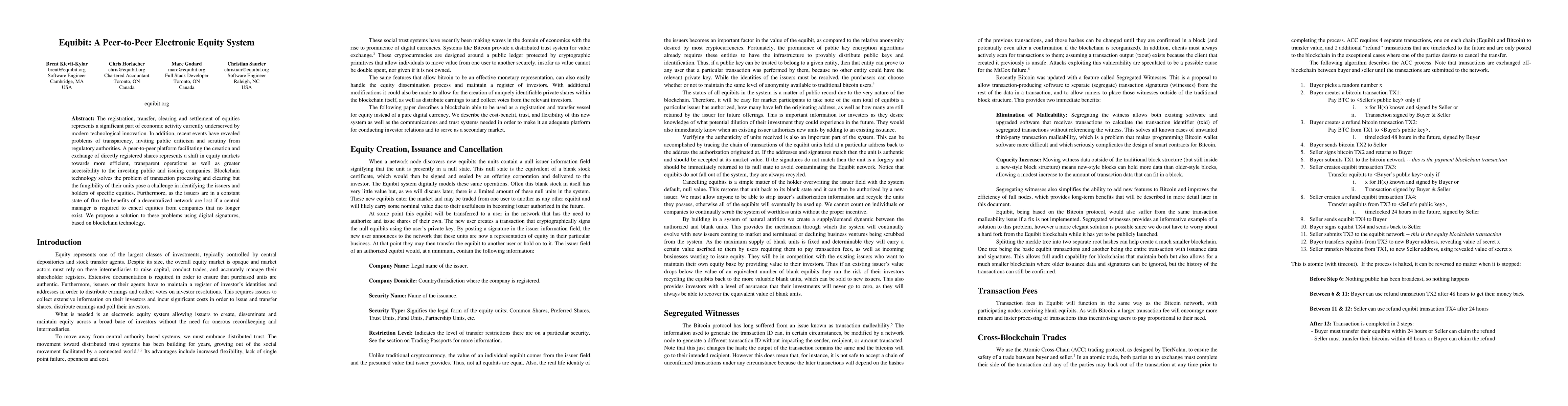

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSwarm: Cost-Efficient Video Content Distribution with a Peer-to-Peer System

Yan Ma, Jialin Li, Jiao Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)