Authors

Summary

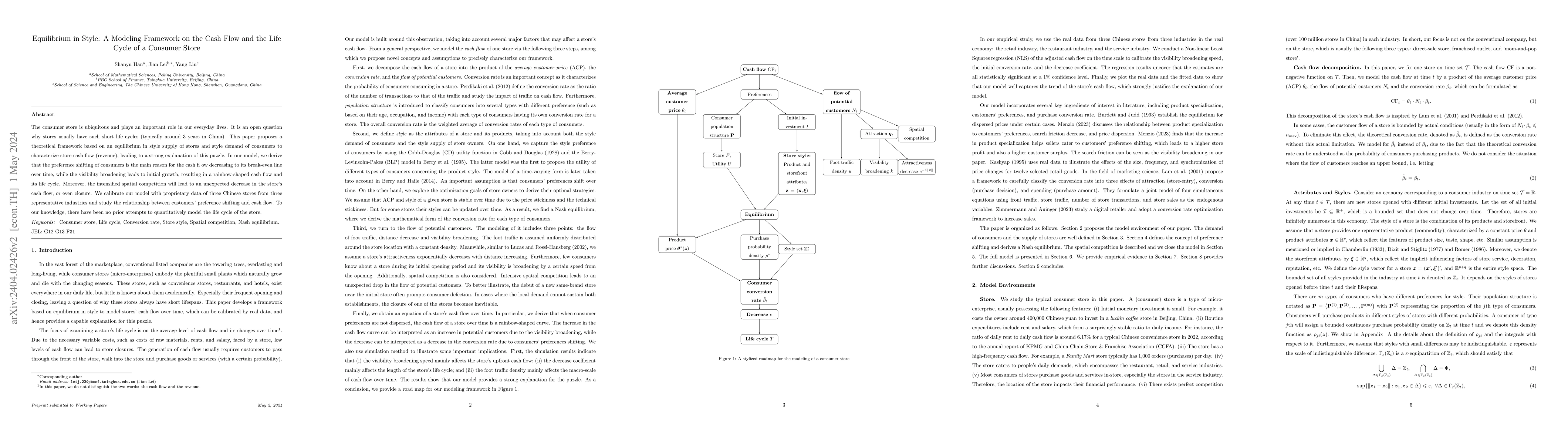

The consumer store is ubiquitous and plays an important role in our everyday lives. It is an open question why stores usually have such short life cycles (typically around 3 years in China). This paper proposes a theoretical framework based on an equilibrium in style supply of stores and style demand of consumers to characterize store cash flow (revenue), leading to a strong explanation of this puzzle. In our model, we derive that the preference shifting of consumers is the main reason for the cash flow decreasing to its break-even line over time, while the visibility broadening leads to initial growth, resulting in rainbow-shaped cash flow and its life cycle. Moreover, the intensified spatial competition will lead to an unexpected decrease in the store's cash flow, or even closure. We calibrate our model with proprietary data of three Chinese stores from three representative industries and study the relationship between customers' preference shifting and cash flow. To our knowledge, there have been no prior attempts to quantitatively model the life cycle of the store.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquilibrium Cycle: A "Dynamic" Equilibrium

Veeraruna Kavitha, Jayakrishnan Nair, Tushar Shankar Walunj et al.

No citations found for this paper.

Comments (0)