Summary

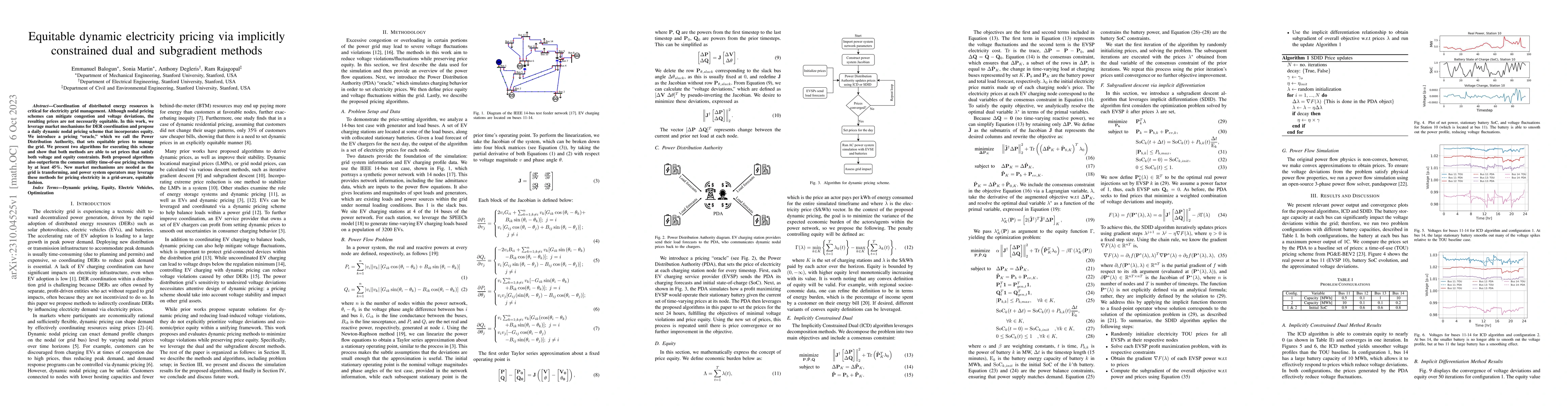

Coordination of distributed energy resources is critical for electricity grid management. Although nodal pricing schemes can mitigate congestion and voltage deviations, the resulting prices are not necessarily equitable. In this work, we leverage market mechanisms for DER coordination and propose a daily dynamic nodal pricing scheme that incorporates equity. We introduce a pricing "oracle," which we call the Power Distribution Authority, that sets equitable prices to manage the grid. We present two algorithms for executing this scheme and show that both methods are able to set prices that satisfy both voltage and equity constraints. Both proposed algorithms also outperform the common utility time-of-use pricing schemes by at least 45%. New market mechanisms are needed as the grid is transforming, and power system operators may leverage these methods for pricing electricity in a grid-aware, equitable fashion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDual Pricing to Prioritize Renewable Energy and Consumer Preferences in Electricity Markets

Samuel Chevalier, Shie Mannor, Spyros Chatzivasileiadis et al.

Some Primal-Dual Theory for Subgradient Methods for Strongly Convex Optimization

Benjamin Grimmer, Danlin Li

| Title | Authors | Year | Actions |

|---|

Comments (0)