Summary

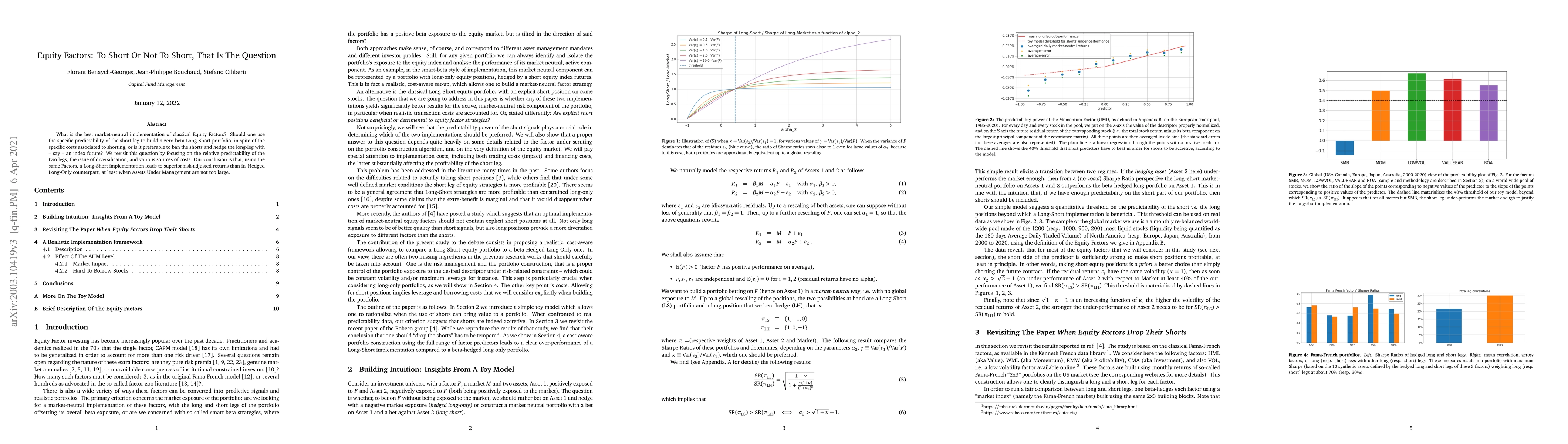

What is the best market-neutral implementation of classical Equity Factors? Should one use the specific predictability of the short-leg to build a zero beta Long-Short portfolio, in spite of the specific costs associated to shorting, or is it preferable to ban the shorts and hedge the long-leg with -- say -- an index future? We revisit this question by focusing on the relative predictability of the two legs, the issue of diversification, and various sources of costs. Our conclusion is that, using the same Factors, a Long-Short implementation leads to superior risk-adjusted returns than its Hedged Long-Only counterpart, at least when Assets Under Management are not too large.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTo reset, or not to reset -- that is the question

György P. Gehér, Earl T. Campbell, Ophelia Crawford et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)