Authors

Summary

Long term investment is one of the major investment strategies. However, calculating intrinsic value of some company and evaluating shares for long term investment is not easy, since analyst have to care about a large number of financial indicators and evaluate them in a right manner. So far, little help in predicting the direction of the company value over the longer period of time has been provided from the machines. In this paper we present a machine learning aided approach to evaluate the equity's future price over the long time. Our method is able to correctly predict whether some company's value will be 10% higher or not over the period of one year in 76.5% of cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

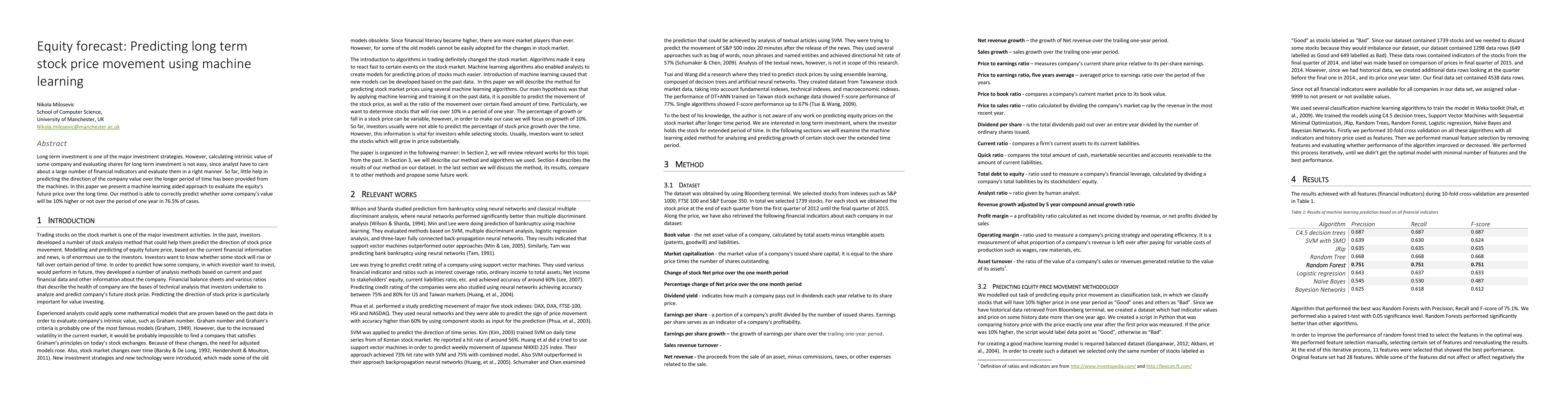

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting Nigerian Equity Stock Returns Using Long Short-Term Memory Technique

Adebola K. Ojo, Ifechukwude Jude Okafor

| Title | Authors | Year | Actions |

|---|

Comments (0)