Summary

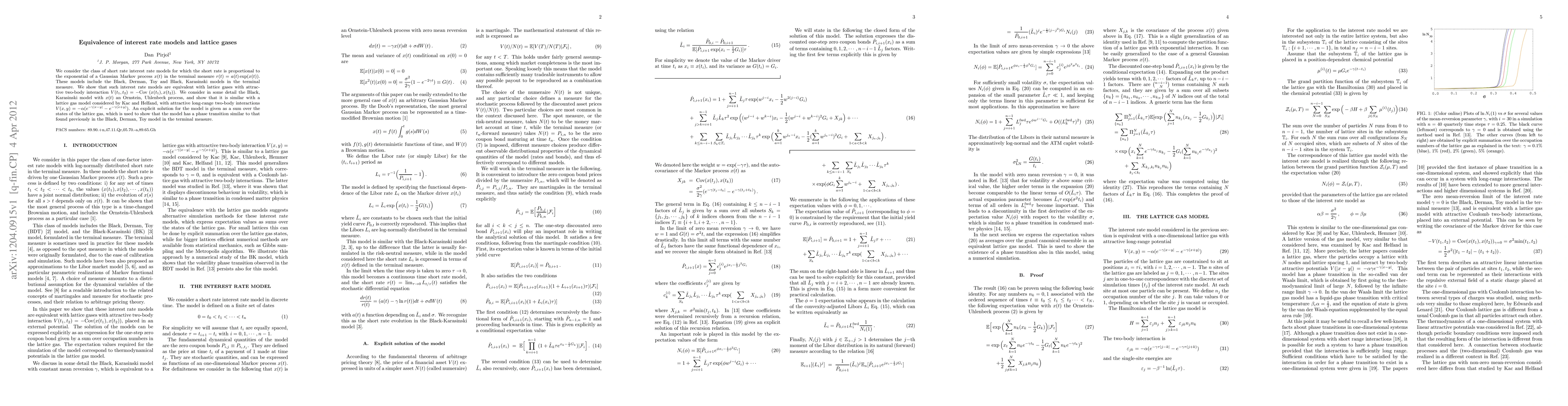

We consider the class of short rate interest rate models for which the short rate is proportional to the exponential of a Gaussian Markov process x(t) in the terminal measure r(t) = a(t) exp(x(t)). These models include the Black, Derman, Toy and Black, Karasinski models in the terminal measure. We show that such interest rate models are equivalent with lattice gases with attractive two-body interaction V(t1,t2)= -Cov(x(t1),x(t2)). We consider in some detail the Black, Karasinski model with x(t) an Ornstein, Uhlenbeck process, and show that it is similar with a lattice gas model considered by Kac and Helfand, with attractive long-range two-body interactions V(x,y) = -\alpha (e^{-\gamma |x - y|} - e^{-\gamma (x + y)}). An explicit solution for the model is given as a sum over the states of the lattice gas, which is used to show that the model has a phase transition similar to that found previously in the Black, Derman, Toy model in the terminal measure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)