Authors

Summary

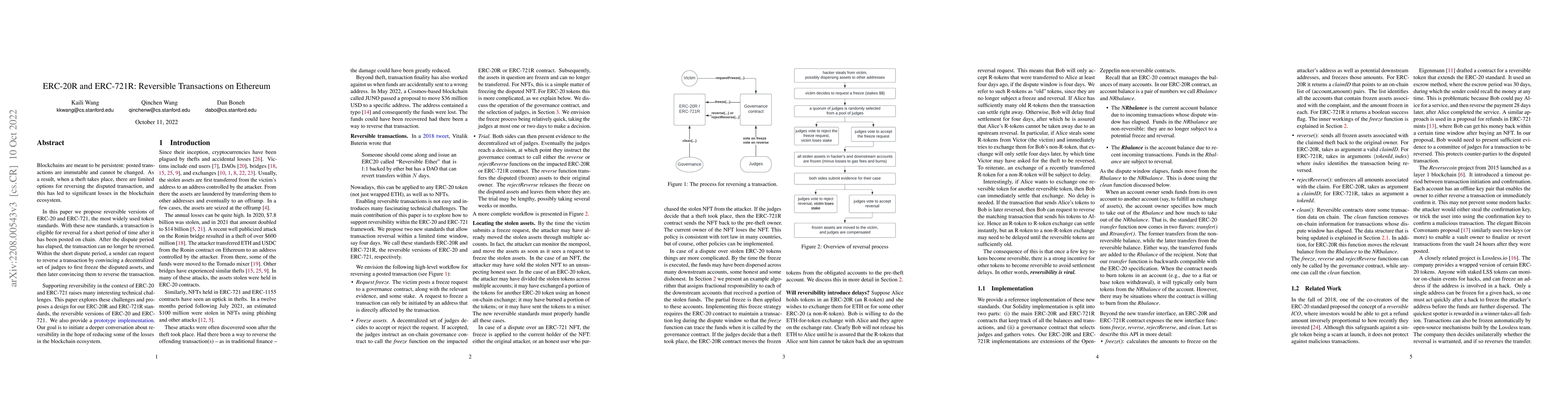

Blockchains are meant to be persistent: posted transactions are immutable and cannot be changed. When a theft takes place, there are limited options for reversing the disputed transaction, and this has led to significant losses in the blockchain ecosystem. In this paper we propose reversible versions of ERC-20 and ERC-721, the most widely used token standards. With these new standards, a transaction is eligible for reversal for a short period of time after it has been posted on chain. After the dispute period has elapsed, the transaction can no longer be reversed. Within the short dispute period, a sender can request to reverse a transaction by convincing a decentralized set of judges to first freeze the disputed assets, and then later convincing them to reverse the transaction. Supporting reversibility in the context of ERC-20 and ERC-721 raises many interesting technical challenges. This paper explores these challenges and proposes a design for our ERC-20R and ERC-721R standards, the reversible versions of ERC-20 and ERC-721. We also provide a prototype implementation. Our goal is to initiate a deeper conversation about reversibility in the hope of reducing some of the losses in the blockchain ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersR-Pool and Settlement Markets for Recoverable ERC-20R Tokens

Dan Boneh, Kaili Wang, Qinchen Wang et al.

W2E (Workout to Earn): A Low Cost DApp based on ERC-20 and ERC-721 standards

Do Hai Son, Nguyen Danh Hao, Tran Thi Thuy Quynh et al.

Characterizing Transfer Graphs of Suspicious ERC-20 Tokens

Andrey Kuehlkamp, Jarek Nabrzyski, Calvin Josenhans

| Title | Authors | Year | Actions |

|---|

Comments (0)