Summary

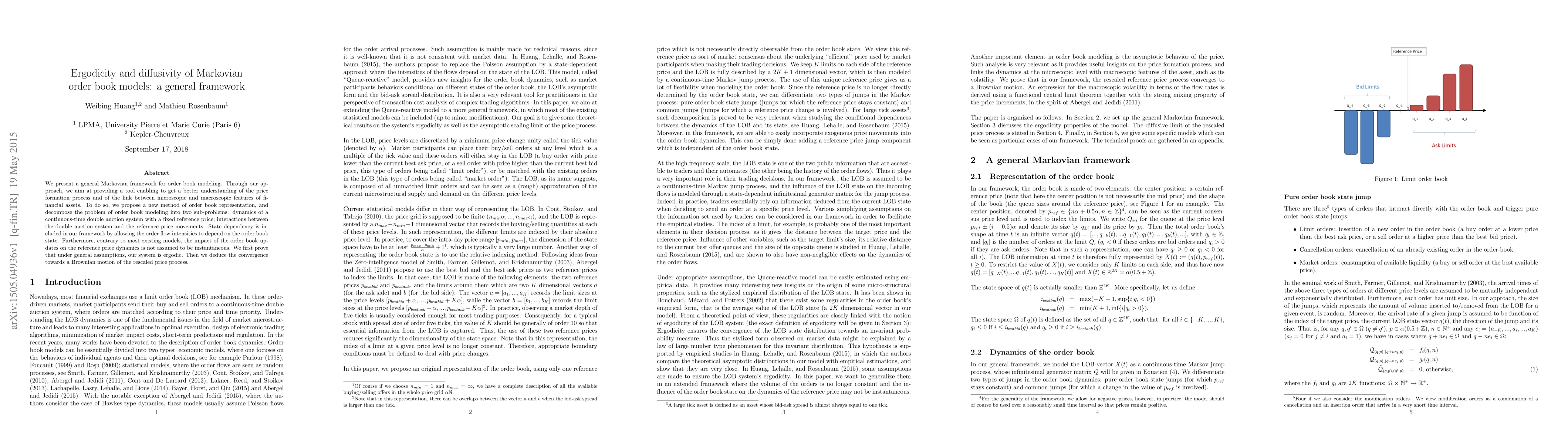

We present a general Markovian framework for order book modeling. Through our approach, we aim at providing a tool enabling to get a better understanding of the price formation process and of the link between microscopic and macroscopic features of financial assets. To do so, we propose a new method of order book representation, and decompose the problem of order book modeling into two sub-problems: dynamics of a continuous-time double auction system with a fixed reference price; interactions between the double auction system and the reference price movements. State dependency is included in our framework by allowing the order flow intensities to depend on the order book state. Furthermore, contrary to most existing models, the impact of the order book updates on the reference price dynamics is not assumed to be instantaneous. We first prove that under general assumptions, our system is ergodic. Then we deduce the convergence towards a Brownian motion of the rescaled price process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOrder Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

A mathematical framework for modelling order book dynamics

Pierre Degond, Rama Cont, Lifan Xuan

A time-dependent Markovian model of a limit order book

Jonathan A. Chávez-Casillas

| Title | Authors | Year | Actions |

|---|

Comments (0)