Summary

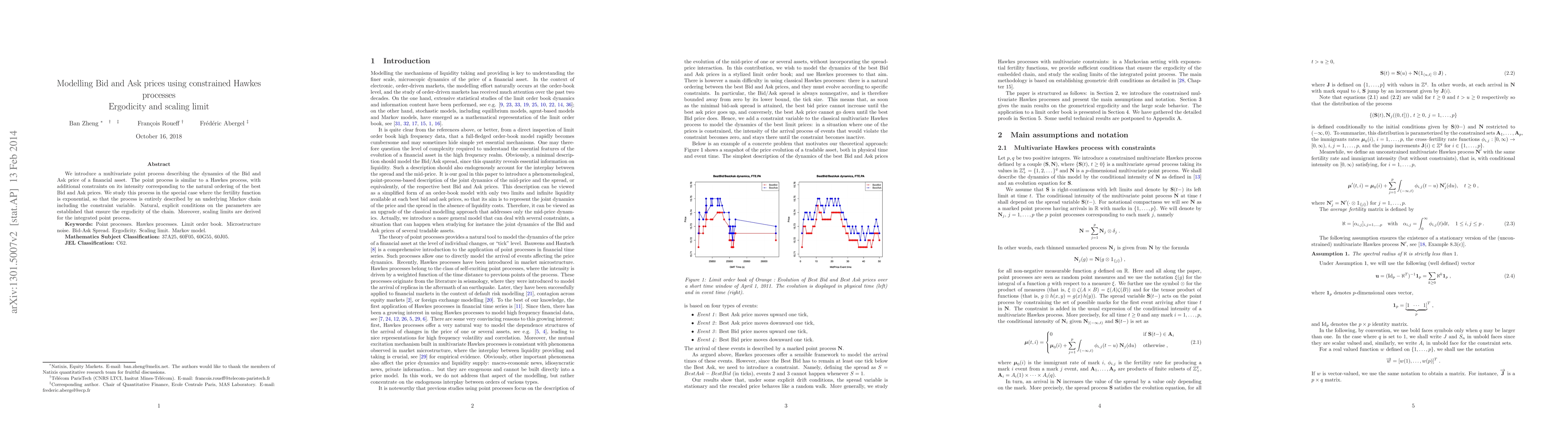

We introduce a multivariate Hawkes process with constraints on its conditional density. It is a multivariate point process with conditional intensity similar to that of a multivariate Hawkes process but certain events are forbidden with respect to boundary conditions on a multidimensional constraint variable, whose evolution is driven by the point process. We study this process in the special case where the fertility function is exponential so that the process is entirely described by an underlying Markov chain, which includes the constraint variable. Some conditions on the parameters are established to ensure the ergodicity of the chain. Moreover, scaling limits are derived for the integrated point process. This study is primarily motivated by the stochastic modelling of a limit order book for high frequency financial data analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)