Summary

We study an expansion method for high-dimensional parabolic PDEs which constructs accurate approximate solutions by decomposition into solutions to lower-dimensional PDEs, and which is particularly effective if there are a low number of dominant principal components. The focus of the present article is the derivation of sharp error bounds for the constant coefficient case and a first and second order approximation. We give a precise characterisation when these bounds hold for (non-smooth) option pricing applications and provide numerical results demonstrating that the practically observed convergence speed is in agreement with the theoretical predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

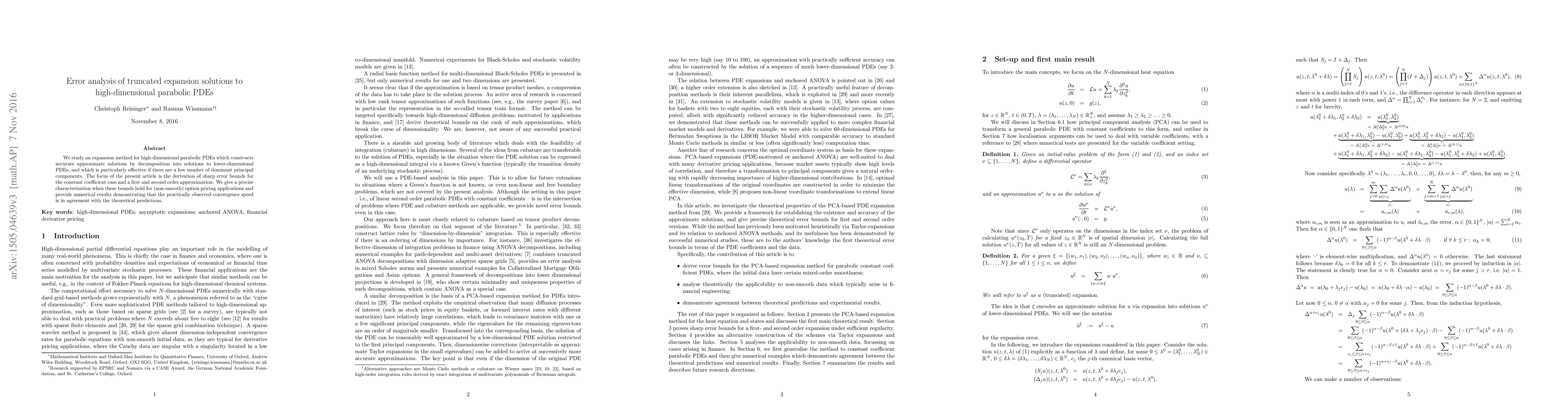

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)