Summary

We designed a machine learning algorithm that identifies patterns between ESG profiles and financial performances for companies in a large investment universe. The algorithm consists of regularly updated sets of rules that map regions into the high-dimensional space of ESG features to excess return predictions. The final aggregated predictions are transformed into scores which allow us to design simple strategies that screen the investment universe for stocks with positive scores. By linking the ESG features with financial performances in a non-linear way, our strategy based upon our machine learning algorithm turns out to be an efficient stock picking tool, which outperforms classic strategies that screen stocks according to their ESG ratings, as the popular best-in-class approach. Our paper brings new ideas in the growing field of financial literature that investigates the links between ESG behavior and the economy. We show indeed that there is clearly some form of alpha in the ESG profile of a company, but that this alpha can be accessed only with powerful, non-linear techniques such as machine learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

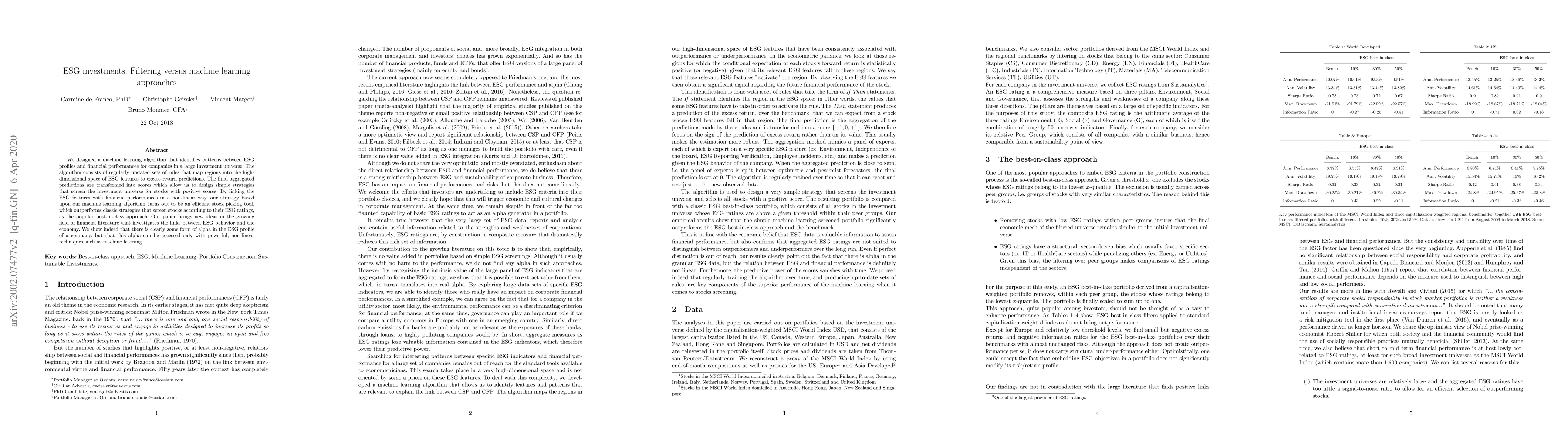

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Optimization of ESG Financial Investments

Eduardo C. Garrido-Merchán, Gabriel González Piris, Maria Coronado Vaca

Evaluating the resilience of ESG investments in European Markets during turmoil periods

Pierdomenico Duttilo, Stefano Antonio Gattone, Barbara Iannone

The Resurgence of Trumponomics: Implications for the Future of ESG Investments in a Changing Political Landscape

Innocentus Alhamis

Denoising ESG: quantifying data uncertainty from missing data with Machine Learning and prediction intervals

Sergio Caprioli, Jacopo Foschi, Riccardo Crupi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)