Summary

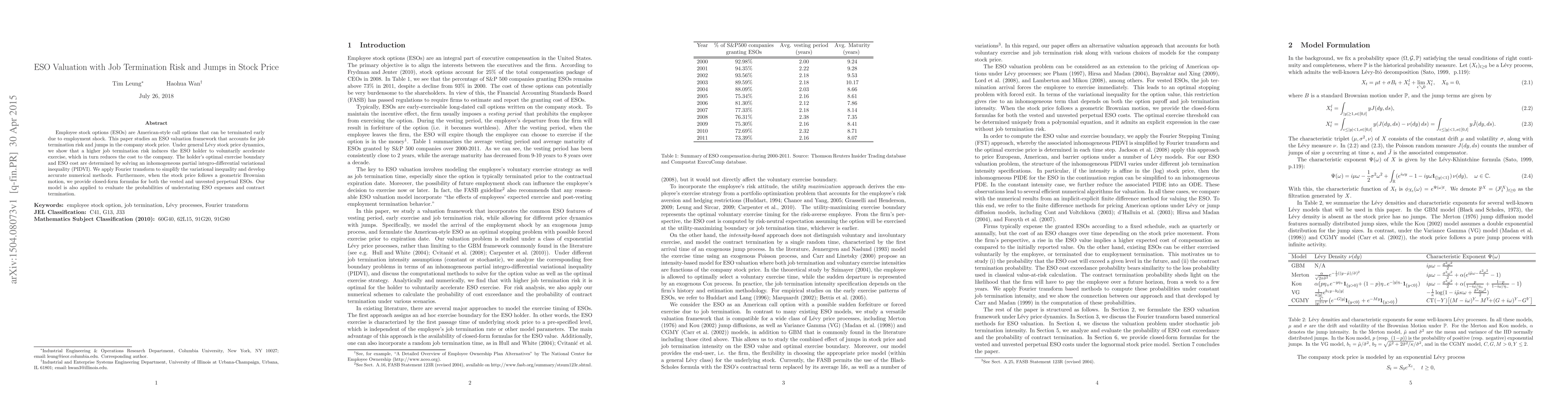

Employee stock options (ESOs) are American-style call options that can be terminated early due to employment shock. This paper studies an ESO valuation framework that accounts for job termination risk and jumps in the company stock price. Under general L\'evy stock price dynamics, we show that a higher job termination risk induces the ESO holder to voluntarily accelerate exercise, which in turn reduces the cost to the company. The holder's optimal exercise boundary and ESO cost are determined by solving an inhomogeneous partial integro-differential variational inequality (PIDVI). We apply Fourier transform to simplify the variational inequality and develop accurate numerical methods. Furthermore, when the stock price follows a geometric Brownian motion, we provide closed-form formulas for both the vested and unvested perpetual ESOs. Our model is also applied to evaluate the probabilities of understating ESO expenses and contract termination.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine learning approach to stock price crash risk

Abdullah Karasan, Ozge Sezgin Alp, Gerhard-Wilhelm Weber

| Title | Authors | Year | Actions |

|---|

Comments (0)